Stay connected with BizTech Community—follow us on Instagram and Facebook for the latest news and reviews delivered straight to you.

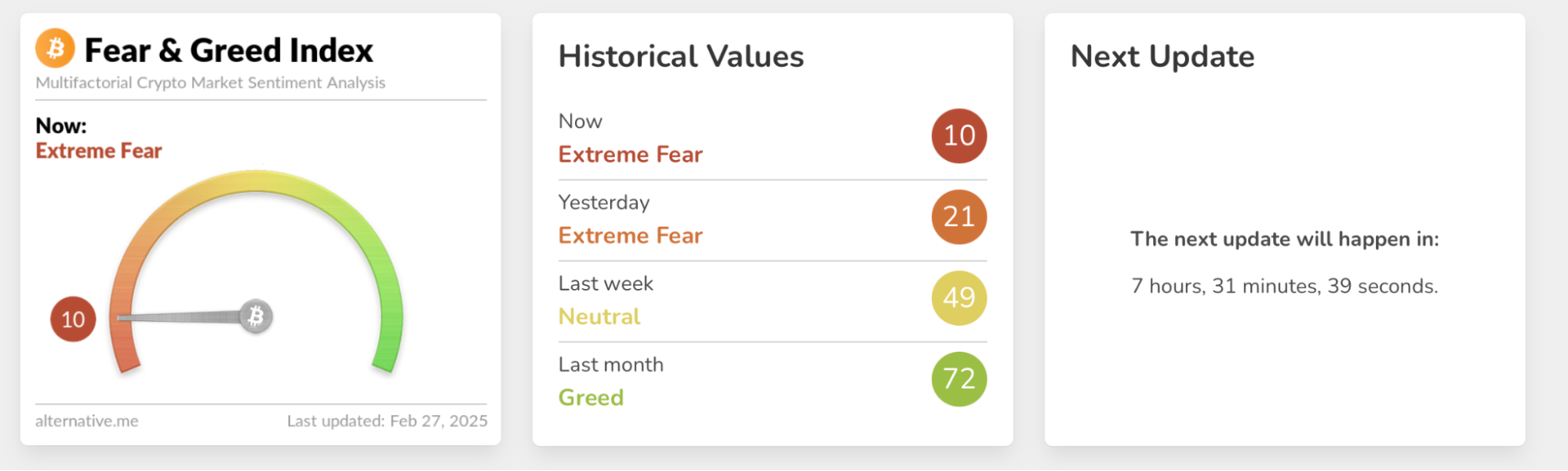

The crypto market is again gripped by panic, with the Fear and Greed Index—an indicator of investor sentiment towards crypto assets—plummeting to its lowest level in seven months. According to data from Alternative.me on Wednesday (2/26/2025), the index is now at a score of 21, down from 25 the day before. This figure indicates “Extreme Fear,” last seen on August 8, 2024, when the score hit 20 amid a severe bear market.

The Fear and Greed Index, which moves on a scale of 0 to 100, reflects market emotions: a low score indicates excessive fear, while a high score indicates euphoria or “Extreme Greed”. This drastic decline was triggered by a combination of global economic factors, political policies, and security events in the crypto industry, all of which contributed to a loss of investor confidence.

The Main Cause of Market Panic

One of the main triggers was the massive outflow of funds from the Bitcoin Exchange-Traded Fund (ETF) product. From February 19 to February 25, 2025, more than US$1 billion was reportedly withdrawn from the ETF.

Investor confidence, which had surged after Donald Trump’s victory in the November 2024 US election—when Bitcoin broke through US$100,000 for the first time—is now beginning to fade.

Trump’s economic policies also added to the turmoil. In a joint press conference with French President Emmanuel Macron on February 24, 2025, Trump confirmed the imposition of 25% import tariffs on Canada and Mexico as planned.

The impact was immediate: Bitcoin fell from US$92,000 to US$86,138 in 24 hours, dropping more than 7%, while Ethereum fell 10% from US$2,500 to US$2,300, according to CoinMarketCap.

Global uncertainty has been exacerbated by the US Federal Reserve’s quantitative tightening (QT) policy, which rules out the possibility of interest rate cuts in the near future. The US stock market was also affected, with the S&P 500 falling nearly 2% last Friday—the biggest drop in two months—which also dragged the crypto market into bearish pressure.

Bybit Hack and Investor Distrust

In addition to macroeconomic factors, security incidents also worsened sentiment. On February 21, 2025, the crypto exchange Bybit fell victim to a massive hack, losing $1.46 billion worth of Ether.

Also read: Bybit’s $1.5B Hack: Trigger for a Crypto Bear Market?

This was one of the biggest crypto thefts in history, further highlighting the vulnerability of the industry. The incident caused many investors, especially beginners, to withdraw their funds, deepening the market correction.

Opportunities in the Midst of Fear

Although the market atmosphere is dominated by fear, history shows that periods of “Extreme Fear” are often turning points. Assets that are considered oversold can attract long-term investors to enter at a low price, taking advantage of the potential for a rebound.

However, global uncertainty has led many market participants to choose to wait for clearer signals of recovery.

Conclusion

The current state of the crypto market is a reflection of global economic tensions, aggressive political policies, and security challenges in the industry.

Bitcoin’s decline to US$86,000 and the domino effect on altcoins such as Ethereum and Solana show how fragile investor sentiment is. Although there are opportunities for those who dare to take risks, the majority seem to prefer to keep their distance, awaiting the stability that is currently missing from the crypto market.