Stay connected with BizTech Community—follow us on Instagram and Facebook for the latest news and reviews delivered straight to you.

Bitcoin (BTC) is back in the financial spotlight after experiencing a significant price surge over the weekend leading up to early March 2025.

The price of BTC jumped more than 10% in a few days, driven by two main factors: US President Donald Trump’s executive order to form a Crypto Strategic Reserve and a massive buying spree by investors taking advantage of the previous week’s market liquidation.

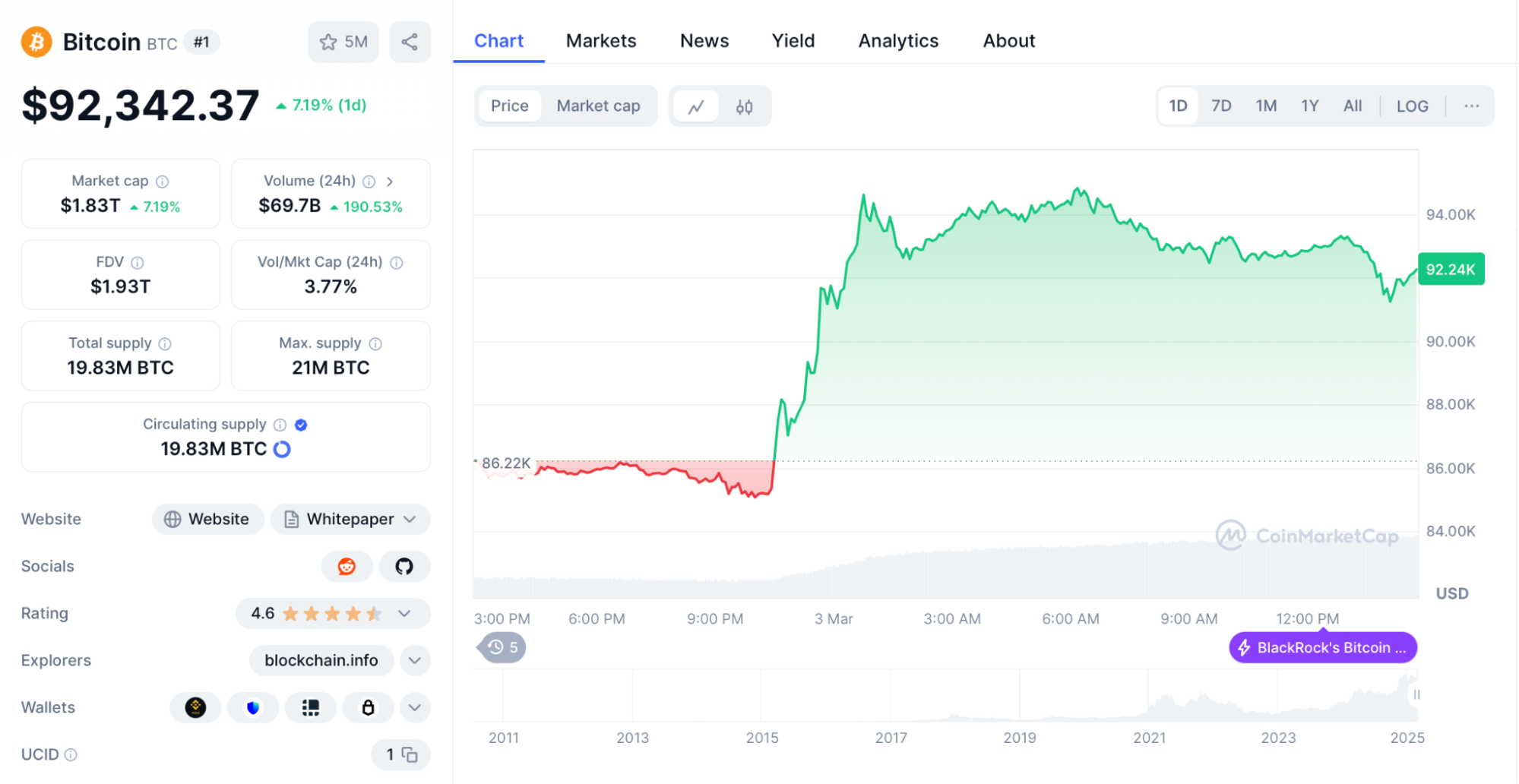

On March 2, 2025, the price of Bitcoin was recorded at $93,045 (around Rp1.53 trillion), up 7.38% in the last 24 hours, with a market capitalization of $1.84 trillion, according to CoinMarketCap data.

Bitcoin’s Resurgence from the Lowest Point

February 2025 was a challenging month for Bitcoin. The BTC price plummeted more than 25%, reaching a low of $78,200 on February 28—its lowest level in 120 days. The decline was triggered by global economic uncertainty, especially after Trump’s decision to impose import tariffs on Canada and Mexico starting March 1.

This policy triggered a capital withdrawal from risky assets, including stocks in major indexes such as the S&P 500, Nikkei, and DAX, which also fell double digits ahead of the tariff imposition.

However, as reported by TradingView via Coingape, strategic investors began to enter at this low point. This buying action was the initial catalyst for price recovery, bringing BTC back to the $85,000 level on Saturday, before finally surging higher after Trump’s important announcement.

Crypto Strategic Reserve: Trump’s Bold Move

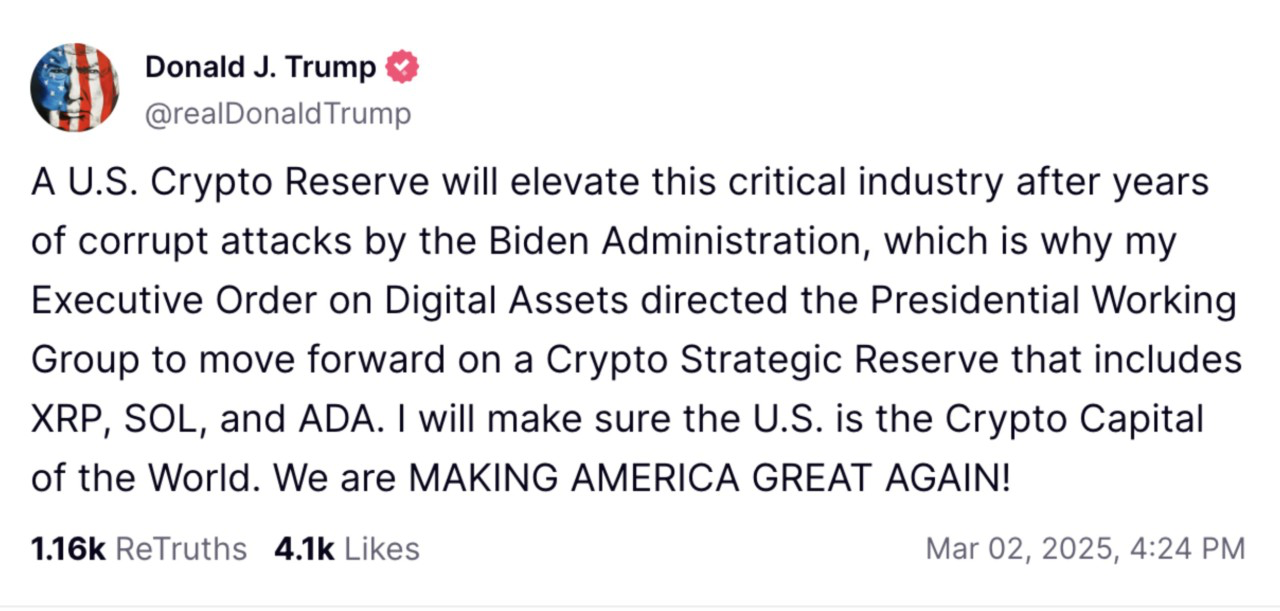

On Sunday, March 2, 2025, President Trump announced via Truth Social an executive order to form the Crypto Strategic Reserve—the first official digital asset reserve in the United States.ff

Not only Bitcoin, this reserve will also include Solana (SOL), Ripple (XRP), and Cardano (ADA). This move signals the US government’s formal recognition of crypto assets as part of the national financial strategy, while reflecting Trump’s consistent pro-crypto stance.

The impact was immediate. Within an hour of the announcement, the price of Bitcoin rose 3%, briefly breaking $91,000.

Some analysts call this policy a “game-changer” for the crypto ecosystem, with the potential to increase legitimacy and institutional adoption. One X user, @CryptoInsiderX, commented, “Trump has just given BTC the official stamp of approval. This is the biggestf bullish signal in US crypto history.”

Asset Diversification: Short- and Long-Term Impacts

Unlike initial predictions that Bitcoin would be the only asset in reserve—as El Salvador and Bhutan did—Trump opted for a diversification approach. By including SOL, XRP, and ADA, the US seems to want to minimize concentration risk and take advantage of the strengths of each project. Although this could slightly reduce Bitcoin’s market dominance in the short term, experts are optimistic that the long-term effects will be positive.

“The spread of capital to four crypto assets may hold back an explosive surge in BTC in the near future. However, the strengthening of the crypto ecosystem as a whole could push Bitcoin beyond $150,000 in the next 6-12 months,” wrote market analyst at X, @BTCBull2025. Increased institutional confidence thanks to US government support is also expected to be a key driver of continued growth.

Market Sentiment Excited: BTC Heading for $100K?

After a sharp correction in February, market sentiment has now turned bullish. Technical data shows an impressive recovery: in two days, BTC rose 16.84% from $78,200 to $90,558, supported by a surge in trading volume of 126% to $63.8 billion in the last 24 hours. The MACD indicator on the 12-hour chart also shows bullish momentum, with the MACD line crossing the signal line—a strong signal that the uptrend is underway.

Currently, Bitcoin is approaching key resistance at $100,000, a psychological level that traders have long awaited. Pressure on short traders is mounting, mainly because the main catalyst for the rise—the Crypto Strategic Reserve—is directly supported by the US government.

“Short sellers are starting to panic. With volume and momentum like this, $95,000 is just one step away before BTC tests $100K,” tweeted @TradeMasterX on X.

However, there is a note of caution. If BTC fails to stay above $88,000, a new wave of liquidation could trigger a correction. Even so, the chances of this bearish scenario seem small given the strength of the current positive sentiment.

Bitcoin as a Hedging Asset

The rise of Bitcoin is also reinforced by the market’s perception that it is increasingly seen as a “safe haven” amid economic uncertainty. With new tariffs on Canada and Mexico, global investors are looking for alternatives to protect their assets from the volatility of traditional markets.

Bitcoin, with its decentralized nature and limited supply, is a top choice, especially after the announcement of the Crypto Strategic Reserve provided additional legitimacy.

Conclusion: Bright Future for Bitcoin

The surge in Bitcoin prices in early March 2025 is proof that this asset remains resilient amid economic turmoil. Support from Trump’s pro-crypto policies, strategic buying by investors, and strengthening market sentiment are the perfect combination to push BTC to new levels.

In the short term, $100,000 seems within reach, while the long-term prospect of $150,000 is increasingly realistic thanks to the strengthening of US government fundamentals.

For market observers, one thing is clear: a new era of digital assets has begun, and Bitcoin is leading the way. Are you ready to ride the next wave?