Stay connected with BizTech Community—follow us on Instagram and Facebook for the latest news and reviews delivered straight to you.

Crypto markets are bracing for a pivotal week as four major US economic events are set to unfold, starting Wednesday, February 12. These macroeconomic developments could significantly impact the portfolios of Bitcoin (BTC) holders and other cryptocurrency investors, making it crucial for market participants to adjust their trading strategies accordingly.

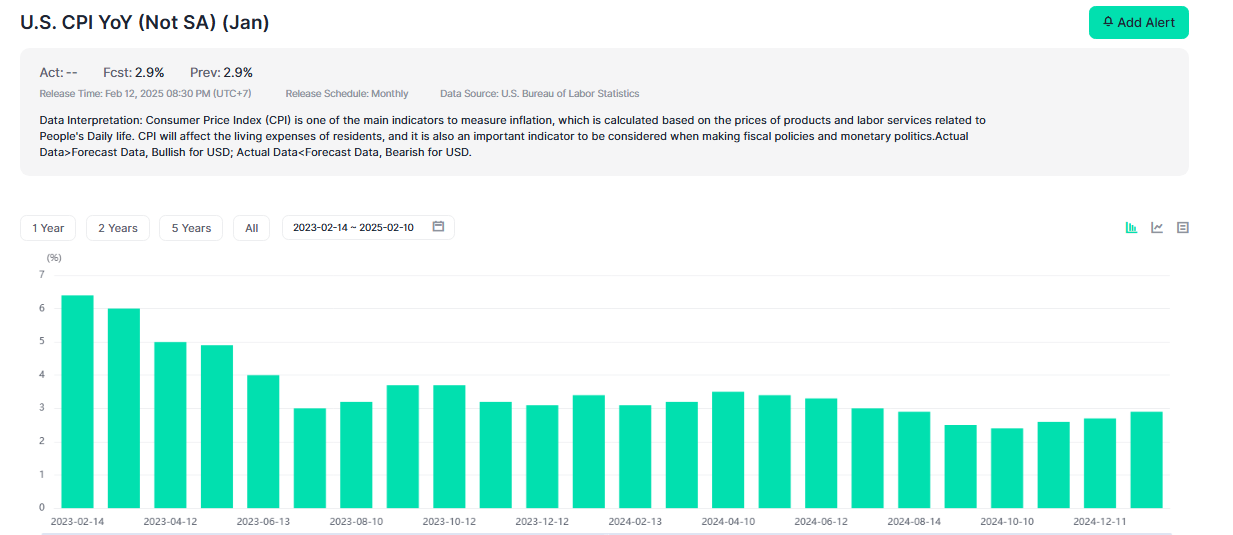

Consumer Price Index (CPI) Report – Wednesday

The January Consumer Price Index (CPI) report, scheduled for release on Wednesday, will kick off the week’s economic events with potential implications for the crypto market. The CPI measures changes in the price level of a basket of consumer goods and services and is a key indicator of inflation. In December, the CPI rate rose slightly to 2.9% year-over-year (YoY), while the core rate, which excludes volatile food and energy prices, dipped to 3.2%.

The Federal Reserve has maintained its benchmark interest rate at 4.25%-4.50% in its latest meeting, emphasizing the need for sustained improvement in inflation before considering rate cuts. According to the Cleveland Fed’s Inflation Nowcasting model, the January CPI rate is expected to come in at 2.85%, reflecting a modest decline of 0.5%. The core rate is also projected to decrease slightly to 3.13%.

The CPI data could have a direct impact on risk-on assets like Bitcoin. Higher-than-expected inflation figures may signal a hawkish stance from the Federal Reserve, potentially leading to a short-term decline in Bitcoin’s value as higher interest rates make traditional investments more attractive. Conversely, lower-than-expected inflation could indicate a more dovish Fed, boosting demand for Bitcoin as investors seek alternative assets to hedge against inflation.

Additionally, remarks from Federal Reserve Chair Jerome Powell will be closely watched. His testimony could provide insights into the future direction of US interest rates and the central bank’s stance on economic policies, including the impact of former President Donald Trump’s tariffs. The Fed has already expressed concerns about Trump’s policies, which have influenced its cautious approach to rate adjustments.

Initial Jobless Claims – Thursday

On Thursday, the US Department of Labor (DoL) will release its weekly jobless claims report, offering a snapshot of the labor market’s health. This data reflects the number of individuals who filed for unemployment insurance in the previous week and serves as a key indicator of economic resilience.

In the latest report, initial jobless claims stood at 219,000 for the week ending February 1. A lower-than-expected figure would suggest continued strength in the job market, potentially signaling steady consumer spending and a robust economy. However, such strength could also prompt the Fed to consider raising interest rates, which might strengthen the US dollar but weigh on Bitcoin and other risk assets.

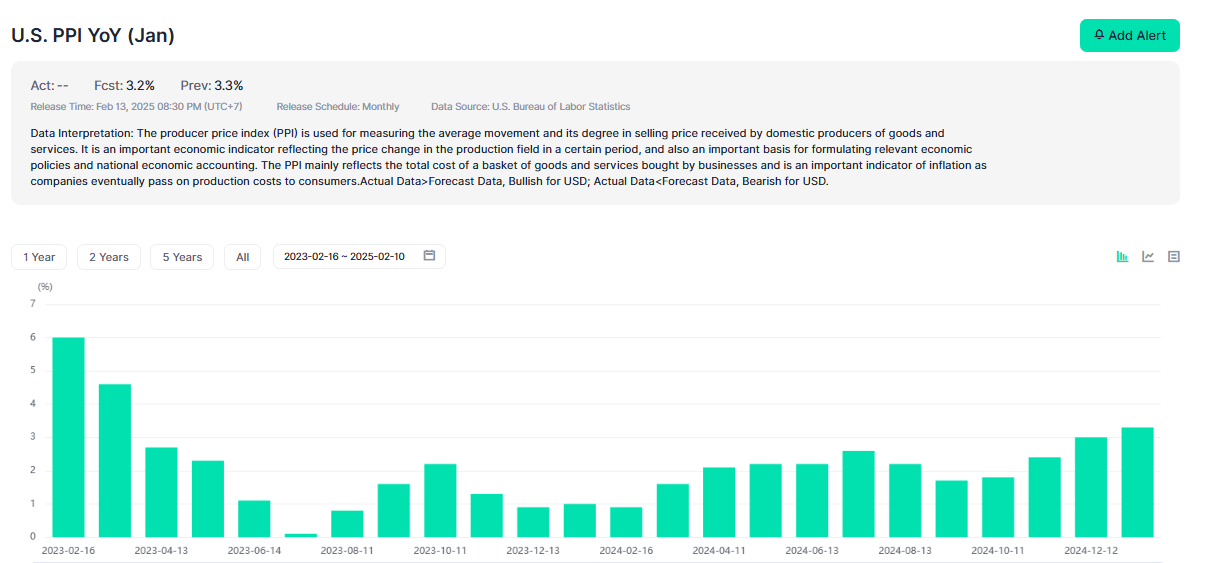

Producer Price Index (PPI) – Thursday

Also on Thursday, the US Bureau of Labor Statistics (BLS) will release the Producer Price Index (PPI) data for January. The PPI measures inflation at the producer level and provides early signals about future consumer prices. December’s PPI came in at 0.2%, indicating easing inflationary pressures. For January, the median forecast is a 0.3% increase.

A higher-than-expected PPI reading could signal rising production costs, potentially leading to higher consumer prices. In such a scenario, investors might turn to Bitcoin as a hedge against inflation, driving up demand and prices. Conversely, lower-than-expected PPI figures could foster a risk-on sentiment in traditional markets, potentially influencing demand for cryptocurrencies.

The correlation between crypto and traditional markets also plays a role. If rising PPI leads to a sell-off in equities, some investors may reallocate their capital to Bitcoin and other digital assets. As crypto analyst Michaël van de Poppe noted, “CPI and PPI are coming in, but also a strong week for Crypto seems to be on the horizon. This week is comparable to any previous crisis period. During crisis periods, you’d want to be bullish, and max pain is upwards, not down.”

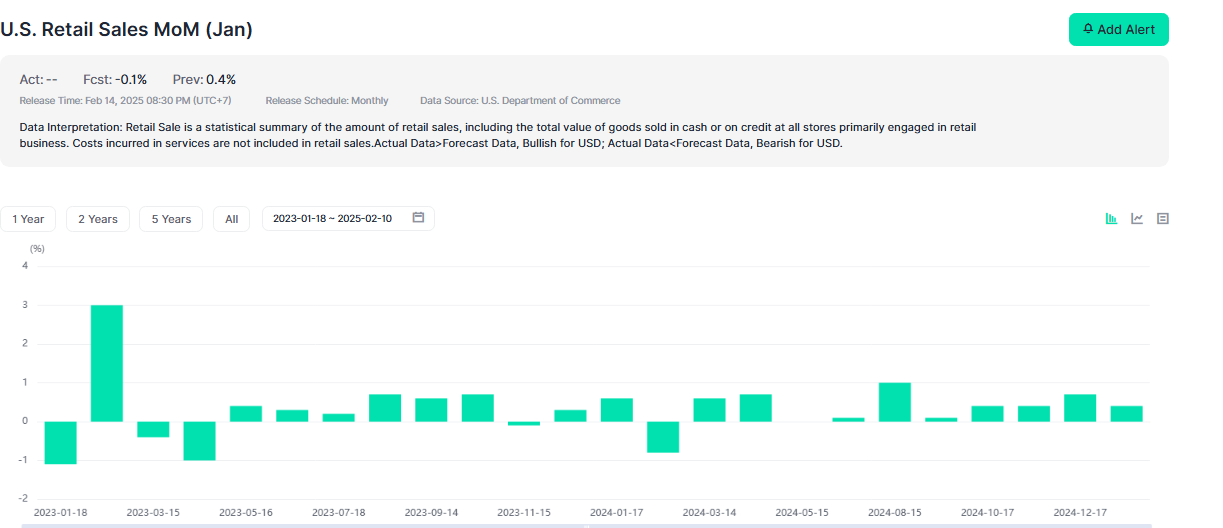

Retail Sales Data – Friday

The week will conclude with the release of US retail sales data on Friday. This report provides valuable insights into consumer spending patterns, economic growth, and overall market sentiment. Strong retail sales figures would indicate robust consumer spending and confidence in the economy, potentially boosting the cryptocurrency market as investors interpret it as a sign of overall market strength.

Higher consumer spending could also lead to increased disposable income, some of which may be allocated to cryptocurrencies like Bitcoin. A positive retail sales report could further fuel risk-on sentiment, benefiting crypto assets.

Conclusion

This week’s US economic events—CPI, jobless claims, PPI, and retail sales—are poised to have a significant impact on the crypto market. Bitcoin and other cryptocurrencies remain sensitive to macroeconomic developments, particularly those influencing inflation, interest rates, and consumer sentiment. Investors should stay vigilant and be prepared to adjust their strategies in response to these key data releases. As the interplay between traditional finance and crypto continues to evolve, understanding these dynamics will be essential for navigating the market effectively.