Stay connected with BizTech Community—follow us on Instagram and Facebook for the latest news and reviews delivered straight to you.

In 2026, Ethereum will go through one of the most important changes in its history. Two big hard forks—Glamsterdam in the middle of the year and Heze-Bogota at the end—will make the network far more scalable, efficient, and resistant to censorship. These improvements build on the success of the Fusaka fork in 2025.

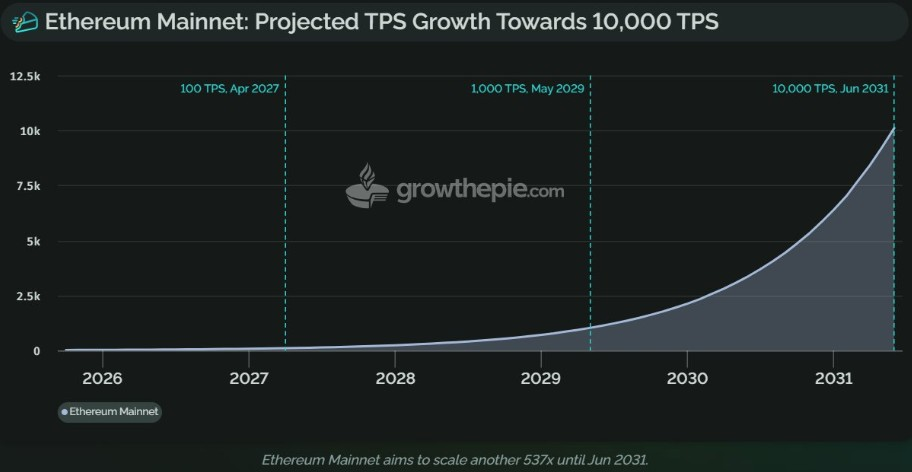

They move Layer 1 closer to 10,000 transactions per second (TPS) and give Layer 2 solutions the power to handle hundreds of thousands of transactions. Perfect parallel processing, big increases in gas limits, more blob capacity, and a slow move of validators to zero-knowledge (ZK) proof verification are all important parts of this achievement.

Justin Drake, an Ethereum researcher, thinks that about 10% of validators could switch to ZK-attesting after Glamsterdam, which would free up more space. These adjustments aren’t small; they’re necessary for a multi-chain world to become widely used. The network processes billions of dollars every day and supports $100 billion in DeFi TVL.

The roadmap shows that Ethereum is taking a slow and steady approach, putting backward compatibility first and working on problems like sequential execution and data availability.

With L2s like Base and zkSync already outpacing activity on the mainnet, the forks of 2026 will make the base layer stronger, turning it into a strong settlement hub instead of a busy highway. Vitalik Buterin, one of the co-founders of Ethereum, often says that the goal is to scale in a way that is safe and keeps decentralization.

Glamsterdam Fork: Gas Limit Surge and Parallel Processing

Glamsterdam, which is set for mid-2026, is the main event. It will have EIPs that allow for “perfect” parallel block execution and ingrained proposer-builder separation (ePBS). These may sound technical, but they have a big effect.

Block Access Lists (EIP-7928) change the way things are done: Right now, Ethereum executes transactions one at a time, like a road with only one lane. Access lists act like a “map” of state changes, letting clients load data ahead of time and conduct transactions that don’t conflict on several CPU cores at the same time. “This gets rid of the biggest bottleneck: reading from the disk one after the other,” says Consensys developer Gabriel Trintinalia. The outcome is higher TPS without needing more hardware, which opens the door to gas restrictions higher than the current 60 million.

Different estimates say: Tomasz Stańczak said that in the first half of the year, there will be 100 million, and after ePBS, that number will double to 200 million. By the end of the year, it might reach 300 million. Buterin warns against being too extreme: “Expect targeted growth, maybe 5 times the gas with 5 times the costs for inefficient operations like storage or big contracts.” This stops bloat and favors dApps that are efficient.

Enshrined PBS has built-in support for MEV-Boost’s builder-proposer split, which gets rid of centralized relays (90% of blocks today). Scaling is one of the benefits: More time for making and checking ZK proofs, which encourages 10% of validators to switch to zkAttesting. Drake says this “decouples validation from execution,” which makes delayed proofs possible and makes censorship harder.

According to Growthepie, Glamsterdam could raise L1 to 10,000 TPS, while blobs—data postings for L2s—may rise to 72+ per block, cutting rollup costs by 40–50%.

Improvements to L2 and Compatibility

Glamsterdam’s blob expansions make Layer 2s even better: From 3-6 now, goals of 72 let chains like Arbitrum and Optimism handle more than 100,000 TPS at a low cost. For example, zkSync’s Atlas upgrade shows this: For security, funds stay on the mainnet, but they run in the Elastic Network’s fast environment, which combines L1 trust with L2 speed.

The planned Ethereum Interoperability Layer will make it easier for different L2s to work together, which will cut down on fragmentation. Users could exchange assets across Base, zkSync, and Polygon without using bridges, which lowered costs and hazards. With L2 TVL reaching $40 billion, this might bring the ecosystem together, competing with Solana’s monolithic approach while keeping Ethereum’s modularity.

Privacy is also becoming more important: ZK capabilities for selective disclosure—proving attributes without revealing all the data—are becoming more integrated, which helps keep DeFi and identity private.

Heze-Bogota Fork: Focus on Resistance to Censorship

The second fork of the year, Heze-Bogota, goes after cypherpunk ideas via Fork-Choice Inclusion Lists (FOCIL). FOCIL requires several validators to include certain transactions, which stops censorship. This was delayed from Glamsterdam because it was too complicated. Trintinalia says, “If part of the network is honest, your tx gets in eventually.” This makes it harder for states or builders to obstruct things, which is important as countries look at CBDCs.

Heze-Bogota might put together held-over EIPs to improve delayed execution for ZK scalability. It limits the upgrades for 2026 and sets the stage for Danksharding and complete Verkle trees in 2027.

Wider Effects on Ethereum’s Ecosystem

These forks solve Ethereum’s scaling trilemma: Throughput without giving up security or decentralization. Parallel execution and ePBS improve the base layer, while blob surges give L2s more power. By the end of the year, there might be more than 500,000 TPS in the ecosystem. For DeFi ($100B TVL), cheaper fees make complicated strategies possible; NFTs and games gain from faster finality.

Ethereum competes with Solana (65,000 TPS) and new players like Sui by being modularly strong: L2 diversity leads to new ideas, such ZK privacy and chains that are exclusive to certain apps. Institutional inflows, like $175 billion in ETFs, speed up as things become clearer.

Problems: Validators need incentives to switch to ZK, and blob spam could raise fees in the short run. Buterin’s planned gas price increases keep everything in balance.

Final Thoughts

Ethereum’s 2026 roadmap—Glamsterdam’s parallel processing and gas surges, Heze-Bogota’s inclusion lists—moves L1 closer to 10,000 TPS and L2s to hundreds of thousands. With 10% of validators looking at ZK and interoperability bringing rollups together, it’s a masterpiece in modular scaling.

Ethereum is ready for mass adoption because privacy, resistance, and efficiency all come together. “2026 lays the foundation,” as Drake says. Keep an eye out for seamless, sovereign finance.