Hyper Liquid is often considered only as a decentralized exchange (DEX) for regular perpetual futures trading. However, Hyper Liquid is actually a Layer 1 blockchain with high performance and extraordinary innovation.

The platform is eagerly awaited due to the launch of the Hyper EVM mainnet and token generation event (TGE) for its token called HYPE. In addition, many users are already farming points for airdrops.

- Hyper Liquid is a high-speed Layer 1 blockchain optimized for trading, handling 100K+ TPS.

- Controls 25-35% of daily perpetual DEX volume, with nearly $400B in cumulative trades.

- Integrated BTC spot trading with low fees and non-custodial transactions.

- Hyper EVM supports ERC-20 tokens; HYPE token projected FDV: $3-4.5B.

- Decentralization in progress, growing from 4 to 40+ validators, but not yet open-source.

Table of Contents

High Performance and Market Dominance on DEX

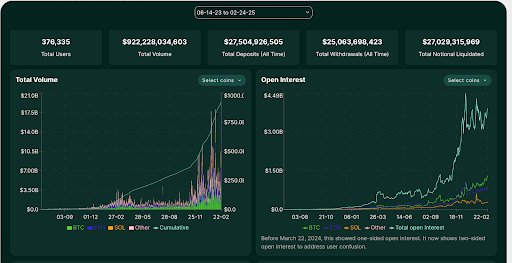

Hyper Liquid is specifically designed for trading with Layer 1 blockchain capable of handling 100,000 transactions per second. Its scalability can reach millions of transactions per second. This enables an on-chain order book with a latency of less than one second, opening up unlimited opportunities for financial applications. Based on data from its official website (hyperfoundation.org), the platform has recorded a 24-hour trading volume of over $6 billion.

The highest open interest is almost $2 billion, while the cumulative trading volume is nearly $922 billion.

Source : stats.hyperliquid.xyz

Hyper Liquid is also one of the largest perpetual DEXs, controlling 35-70% of the daily DEX volume. This figure has risen dramatically from 3-7% a year ago, demonstrating its growing popularity among traders. Many traders choose Hyper Liquid for its smooth trading experience, which is similar to centralized exchanges (CEX) like Binance.

The Team Behind Hyper Liquid

The founders of Hyper Liquid Labs, including Jeff Yan and Alian Sink, have educational backgrounds from Harvard and extensive experience in traditional and crypto finance.

Jeff Yan worked at Hudson River Trading, a well-known high-frequency trading (HFT) company, and founded Chameleon Trading, a top 10 crypto HFT company.

After seeing market inefficiencies and the collapse of FTX, they created Hyper Liquid to improve the quality of decentralized finance (DeFi).

This team has received much attention in the crypto Twitter community, even being referred to as “Binance on-chain” because of its innovation.

Technology and Featured Features

Hyper Liquid uses a custom-built Hyper BFT consensus mechanism, enabling a capacity of up to 2 million transactions per second. One of its flagship features is Hyper EVM, which supports ERC-20 token trading directly on the on-chain order book.

More than 30 teams are building applications on Hyper EVM, and the launch of its mainnet is eagerly awaited.

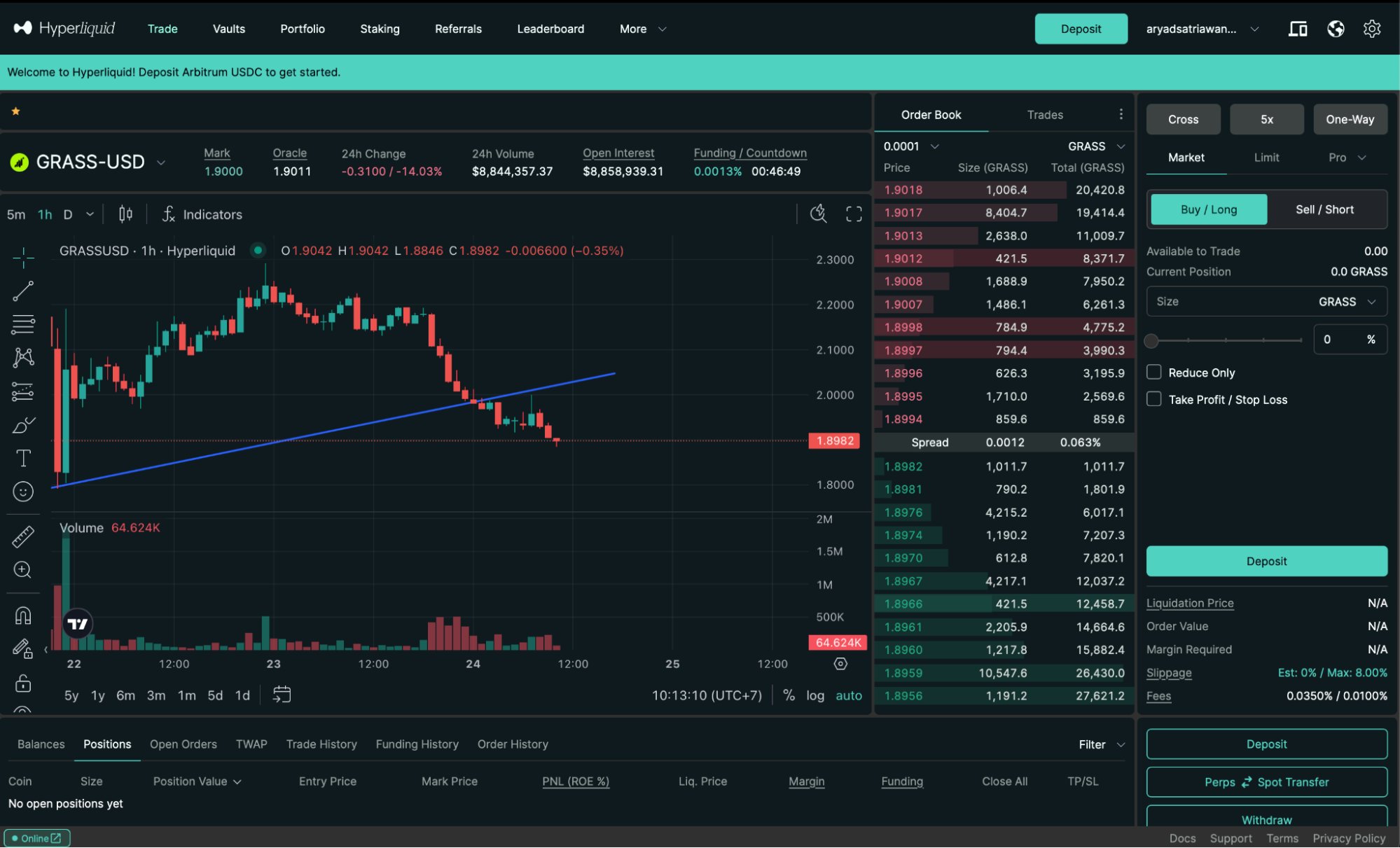

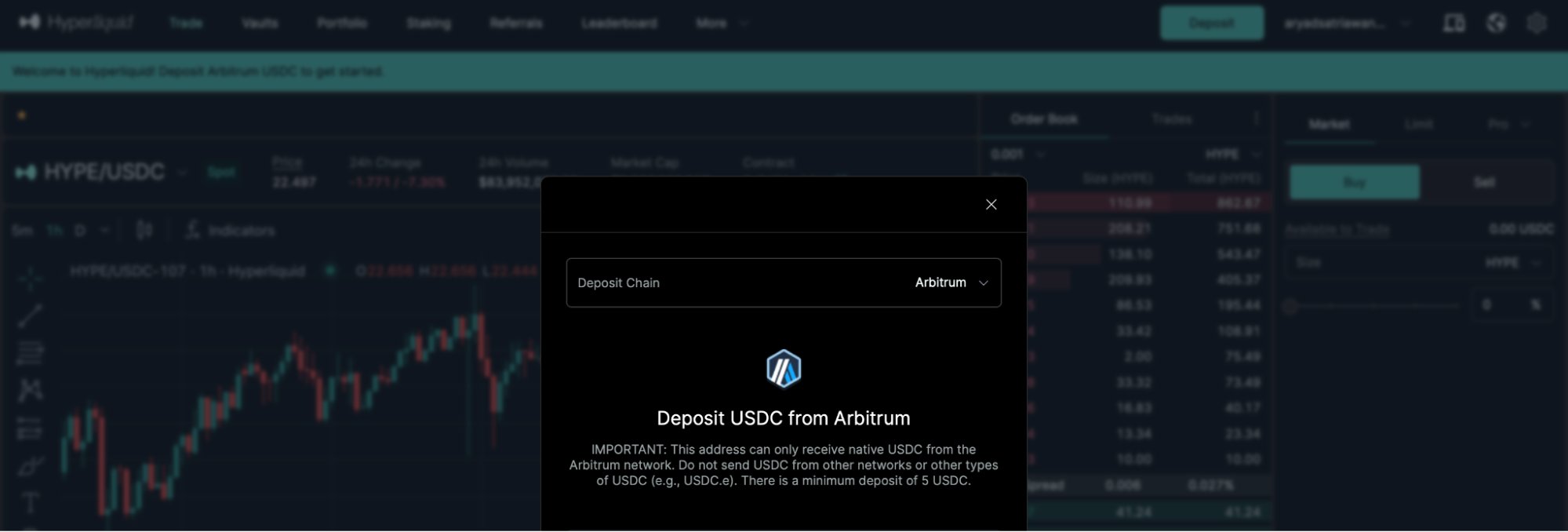

Hyper Liquid’s user experience (UX) is also very smooth. After bridging USDC from Arbitrum, trading can be done with one click without gas fees.

The speed and liquidity are equivalent to CEX tier 1, such as Binance. The platform supports trading from desktop and mobile, including a Progressive Web App (PWA) version that can be installed on mobile phones, providing high flexibility.

One of the newest features is the Hyper Liquid Liquidity Provider (HLP).

Users can deposit USDC to provide liquidity and earn trading fees.

Last November, HLP generated 1.71% per month or around 22.56% per year. There are also Builder Codes, a feature that allows other DeFi applications to utilize Hyper Liquid’s liquidity, such as Octo, a mobile trading hub.

BTC Spot Integration: Hyper Liquid’s Big Move

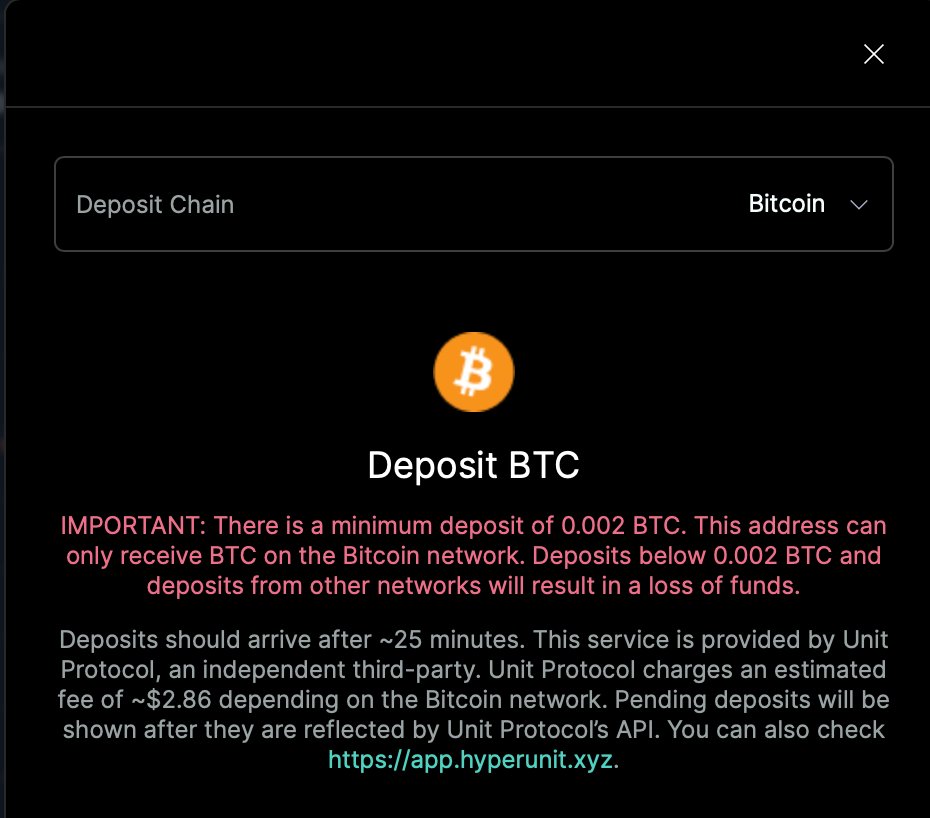

Recently, Hyper Liquid became the first on-chain DEX to integrate Bitcoin (BTC) on a spot basis through Hyper Unit.

This feature allows BTC deposits, withdrawals, and trading in one click, directly connected to the Bitcoin blockchain. In addition to BTC, major assets such as Ethereum (ETH) and Solana (SOL) will also be supported.

This integration is available at app.hyperunit.xyz or directly on the Hyper Liquid platform.

Although non-custodial (users still control assets in personal wallets), Hyper Unit is still centralized, and the source code is not open source. The Guardian Network system with Multi-Party Computation (MPC) is used for verification but still requires trust in the team.

The spot BTC supply on Hyper Liquid now reaches 40 million dollars, with a 90% cheaper withdrawal fee than CEXs like Coinbase.

Future Potential

Hyper Liquid has ambitions to become a complete on-chain financial center, combining spot, perpetual trading, and DeFi applications on one platform.

Its dominance in the DEX market has reached 71.2% globally, taking market share from CEXs such as Binance and other DEXs on Ethereum and Solana. Without funding from venture capital, HYPE token buying pressure is expected to be high at launch due to large distribution to the community.

The valuation of the HYPE token is at 22,68 billion dollars (fully diluted valuation/FDV) based on Coinmarketcap.

The high protocol revenue is also used for HYPE buybacks, averaging 1.5 million dollars daily in February 2025. Some analysts even predict that HYPE could exceed BNB (Binance Coin) or approach Ethereum’s market cap in the future.

Challenges and Criticism

Although innovative, Hyper Liquid still faces criticism. Initially, the platform used four centralized validators, but it is now switching to more than 40 global ones for decentralization.

Its unopen-sourced source code is also a risk, as users have to trust the team’s competence. However, if decentralization and open source are achieved, Hyper Liquid could become the new standard in the crypto industry.

Conclusion

Hyper Liquid is not just an ordinary DEX but a Layer 1 blockchain that changes how crypto trading is done.

With high performance, spot BTC integration, and a strong community, this platform offers an attractive alternative to other CEXs and DEXs. Despite challenges such as decentralization, its potential to dominate the market is enormous.

Hyper Liquid proves that real innovation still exists in the crypto industry, not just speculation or gimmicks.

Malaysia

Malaysia

Singapore

Singapore

Philippines

Philippines