Stay connected with the BizTech Community—follow us on Instagram and Facebook for the latest news and reviews delivered straight to you.

Following the completion of the U.S. election, Donald Trump has emerged as the victor, while the Republican Party has taken full control of Congress, securing both the House of Representatives and the Senate. This political shift appears to have bolstered market confidence, sparking significant positive movement in the U.S. stock market. In fact, this post-election rally has resulted in the year’s strongest performance on Wall Street, reflecting investor optimism in response to the election results. The impact extended beyond traditional financial markets, reaching into the cryptocurrency sector, which has also experienced a robust upswing.

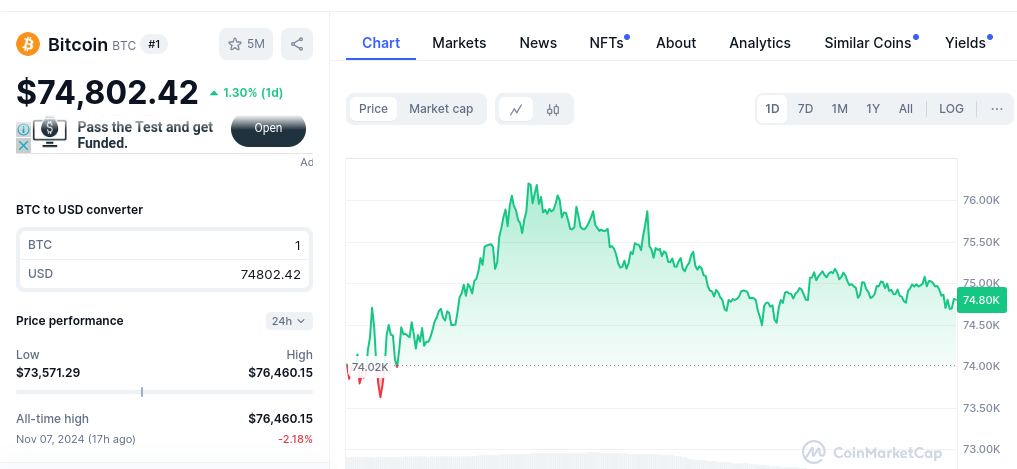

According to CoinMarketCap data on Wednesday, November 5, 2024, Bitcoin has exhibited a remarkable increase, with its value surging up to 13% and hitting a new record high of $76,460. This price surpasses Bitcoin’s previous all-time high of $73,737, which was set in March. While Bitcoin’s price has since undergone a slight correction, it remains within a strong trading range at around $74,802 as of the latest reporting.

In tandem with Bitcoin’s price movement, trading activity has also intensified. Bitcoin’s daily trading volume surged to $71.24 billion, marking a 75% increase from prior levels. This boost in activity highlights the heightened interest and engagement from both retail and institutional investors in the wake of the election. Consequently, Bitcoin’s market capitalization has risen to an impressive $1.47 trillion, further cementing its position as the largest crypto asset by market value.

U.S. Election Fuels Bitcoin’s Rally

Unlike previous Bitcoin rallies, which were often attributed to factors such as the anticipated approval of spot Bitcoin ETFs or enthusiasm surrounding upcoming Bitcoin halvings, the current surge has been heavily influenced by broader economic and political shifts. The U.S. election, serving as a major macroeconomic event, appears to have significantly impacted market sentiment and investor behavior, driving this latest rally.

Since late October, Bitcoin has demonstrated resilience, maintaining levels above $70,000. Notably, there has been a steady increase in inflows into Bitcoin ETFs, signaling a growing appetite for the asset among institutional investors. Analysts suggest that the election outcome has fueled a “fear of missing out” (FOMO) among investors, who view the current political landscape as conducive to further price gains.

This sentiment has led some analysts to predict that Bitcoin could reach new heights by year-end, with projections suggesting that the asset might climb to the $100,000 mark. This potential surge is largely attributed to the election’s role as a strong catalyst for price movements, combined with ongoing institutional interest.

Overall, the interplay between the U.S. election results, market optimism, and Bitcoin’s robust performance underscores the growing influence of political events on cryptocurrency markets. As investors respond to the evolving political and economic landscape, Bitcoin and other digital assets continue to showcase their sensitivity to external factors, underscoring their role as both speculative investments and hedges against macroeconomic uncertainty.

Also Read: Trump vs Harris: Comprehensive Guide to Their Stances and Future Impact On Crypto

Bitcoin Chart Analysis

After experiencing a long sideways, finally in October we broke the trendline resistance at the level of $64,000. Then in early November Bitcoin rallied again to $76,000, which indicates that the “Bullish Flag Pattern” formed during the 6-month sideways has been valid and indicates the continuation of Bitcoin’s bullish trend

If we refer to the chart pattern, the nearest target is $80,000 and in the long term looking at the Fibonacci extension Bitcoin should be able to rise around $100,000 – $125,000.

The $70,000 resistance that has been difficult to break now seems to have become a support that should be strong enough to withstand the rate of price decline if it happens.