Stay connected with BizTech Community—follow us on Instagram and Facebook for the latest news and reviews delivered straight to you.

The recent 2024 BRICS Summit in Russia highlighted significant developments in global attitudes toward cryptocurrency, Bitcoin, and blockchain technology, especially in the context of growing interest in alternative international payment systems. With multiple BRICS nations exploring crypto and blockchain for cross-border transactions, these moves hint at a shifting financial landscape where nations seek solutions outside of traditional U.S. dollar-dominated structures.

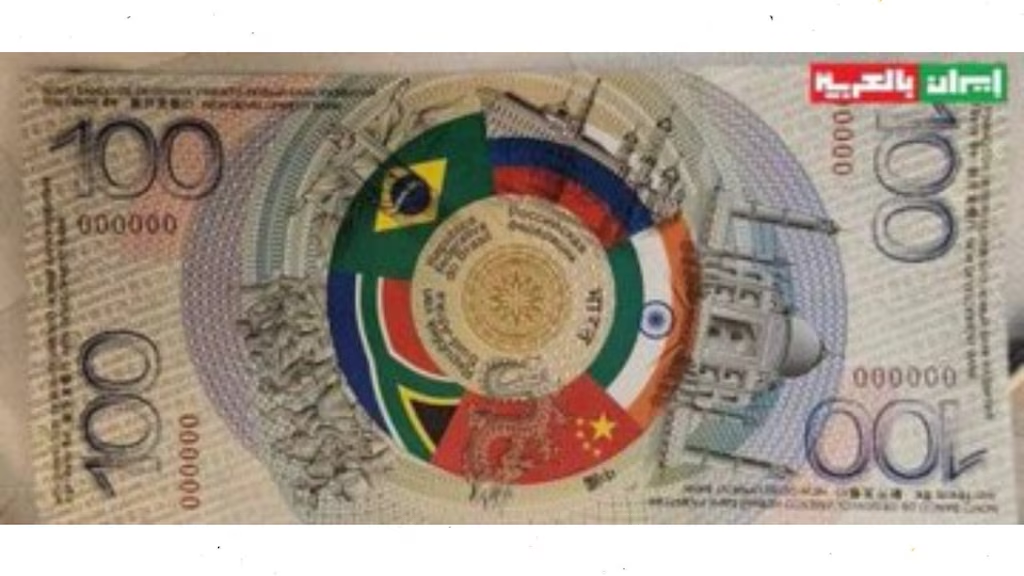

The BRICS Pay Initiative and the Push for De-dollarization

A noteworthy topic at the BRICS Business Forum, which preceded the summit, was the unveiling of BRICS Pay. This proposed blockchain-based payment system aims to facilitate international transactions across both retail and business sectors and may incorporate a dedicated BRICS unit of account for cross-border payments.

The initiative is part of a broader trend among BRICS nations, particularly Russia, to find ways to reduce reliance on the U.S. dollar. With Russia operating under economic sanctions due to its actions in Ukraine, the exploration of blockchain solutions for trade and currency exchange is no surprise, underscoring the theme of “de-dollarization” that permeated summit discussions.

Bitcoin’s Role in International Trade

Beyond blockchain-based payment systems, the BRICS summit also included discussions on Bitcoin’s potential as an instrument for international payments. Reports suggest that Russian bitcoin miners might sell their mined assets to foreign buyers who, in turn, could use Bitcoin to pay for Russian imports, potentially creating an avenue for Russia to bypass sanctions.

These discussions align with recent developments, such as the collaboration between the Russian Direct Investment Fund (RDIF) and BitRiver, a prominent Russian bitcoin mining company. Together, they plan to establish data centers across several BRICS countries, with a focus on both Bitcoin mining and artificial intelligence innovation. Additionally, Russia passed legislation earlier this year permitting cryptocurrencies for international trade (albeit restricting them for domestic payments), while reports from Russian media hint at plans for two state-run crypto exchanges and a stablecoin tied either to the Chinese yuan or to a basket of BRICS currencies.

Mixed Messages on Blockchain and Crypto

The global landscape for blockchain and crypto adoption remains complex and often contradictory. While cryptocurrencies and blockchain solutions are becoming central in discussions on economic future and payment systems, nations worldwide take vastly different stances. In the United States, financial giant BlackRock has championed Bitcoin, while presidential candidate Donald Trump recently proposed adding Bitcoin to the Treasury’s assets. Meanwhile, in Europe, the European Central Bank (ECB) has floated the idea of banning Bitcoin altogether.

For BRICS countries, the drive toward a blockchain-based payment system and Bitcoin-based international trade solutions occurs alongside inconsistent policies. China maintains its cryptocurrency ban, and India has signaled potential crypto restrictions, although it is also considering a digital rupee.

These diverse policies highlight the need to differentiate between types of blockchain technologies. Permissioned, private blockchains—such as those used in central bank digital currencies (CBDCs)—are vastly different from public, permissionless blockchains like Bitcoin, which are designed to operate outside centralized control. This distinction influences each nation’s approach, as CBDCs are viewed by some as susceptible to misuse by authoritative entities, while Bitcoin’s decentralized nature appeals to advocates of financial independence.

The Trump campaign has notably taken a stance opposing the development of a U.S. CBDC, aligning with those who argue that such centralized digital currencies are inherently vulnerable to misuse in authoritarian systems. This perspective reflects a broader debate on whether digital currencies managed by governments can safeguard financial freedoms.

Bitcoin’s Neutrality and the Game Theory of Adoption

The varying responses among nations underline Bitcoin’s neutrality as a technology. Bitcoin advocates have argued that adoption could follow a game-theory-based trajectory, whereby nations compete not to be the last to integrate Bitcoin into their financial systems. The concurrent actions of countries across the geopolitical spectrum reinforce this view, as each seeks to navigate the shifting landscape of global finance without falling behind.

The 2024 BRICS Summit and related developments reveal a global financial landscape in flux. Cryptocurrencies and blockchain-based systems are at the heart of evolving economic strategies, from BRICS nations considering new pathways for international transactions to Western debates on the role of Bitcoin and the risks of centralized digital currencies. As countries explore their options, the mixed messages on blockchain and crypto reflect a fragmented yet accelerating trend—one in which governments weigh the potential benefits and risks of a decentralized, digitally driven global economy.