Malaysia is definitely a beneficial place for anyone to start a business. As a business owner, you will benefit from the expanding entrepreneurial scene with many injections of government initiatives as well as access to a diverse workforce.

In comparison to our neighbouring countries, Malaysia provides competitive taxes and a simple set of regulations to follow should you want to start a business here.

Legally, all businesses are governed by the Companies Act 2016 which provides the framework for incorporating a company in Malaysia.

If you are an aspiring entrepreneur looking to start a business but cannot seem to make sense as to what’s needed for your company registration in Malaysia, then you’ve come to the right place! We have worked on this comprehensive guide that will aid you in your company registration in Malaysia.

In this article, we have outlined a step-by-step process on how to register your company in Malaysia. Not only that, we have also included some pointers for you to consider before and after the registration process.

We hope that this guide will guide you in taking the next steps in making your company a reality!

Table of Contents

Understanding Malaysia Business Structure

Types of Business Entities in Malaysia

Generally, every business must be registered with the Companies Commission of Malaysia (SSM). Prior to registration, however, you need to decide on the structure and the business entity for which you will register.

There are four types of business entities that you can choose from. They all vary from each other; take a look below to understand what they are and how their functions will suit your business needs.

| Sole Proprietorship | Partnership | Private Limited Company (Sdn Bhd) | Public Limited Company (Bhd) | |

| Ownership | Single individual | 2 or more owners; Max : 20 | 1 director or shareholder or up to 50 shareholders | Any number of shareholders |

| Characteristics | – Simplest way to register your business

– Register using a trade name you choose or your personal name – You must be a Malaysian Citizen or a permanent resident |

– Partnership agreements must be established

– Partnership Act 1961 governs it – You must be a Malaysian Citizen or a permanent resident |

-At least 1 director must be a Malaysian but others are open to non-malaysians

-must have a minimum paid up capital of RM1. -allowed to enter into a contract -can sue others and can be sued |

-Public can buy shares of this type of company

-Listed on the Bursa Malaysia Stock Exchange – Securities Commission of Malaysia governs it |

| Pros | -Not costly or complex to set up

-Does not require yearly audit – You have total control of the business, profit and losses |

– Liability is shared among partners

-Audit is not required -Not costly or complex to set up |

– Liability is limited to the owner / shareholder

– Convert to Berhad for public fundraising |

-Open to raising funds from the public

-Liability is limited based on shares ownership – Raise capital for growth and expansion via public markets |

| Cons | -All liability will be borne by yourself

-Unfavourable tax rate since you will be taxed under personal income tax. |

– Does not separate individuals, therefore not a separate legal entity

– Every partner is liable for the liability of partnership – Tax rates are applied at an individual rate of each partner causing a higher tax rate to be charged |

– Cost of incorporating is higher

– Accounts must be audited and submitted yearly – Higher maintenance cost |

-Must disclose financial Reports and earnings to the public

-Required to follow other strict compliance terms -Expensive and complex registration process |

| Registration Fee | Between RM30 – RM60 | Approx. RM60 | Between RM2.5k– RM3k | A few thousand |

Choosing the Right Business Entity for Your Needs

Choosing the right business entity for your business is extremely crucial. As I have highlighted in the above section, each type of business entity comes with its own pros, cons, and costs. But how can you choose the right one for you and your business?

1. Analyse your business goals

Look at your business plan and write down your business’s goals and strategies. This will clarify in deciding which type of business entity will fit for you to achieve your goals. For example, if you’re a small craft business aiming to sell crafts to kids, you don’t need to sign up for a Sdn Bhd, rather sole proprietorship will do.

2. Taxes involved

The larger your set-up, the more tax you will pay. So, it is wise to also look at tax schemes when considering which business entity will suit. Some structures may also allow tax exemption, so choose wisely according to the type and location of your new business.

3. Minimise business risks

Would you like to take on all the risks pertaining to your business? If you know your business might take on certain large risks (which is common in business anyway), why not spread it? Selecting the right entity can help spread some of that risk.

Now that you have looked at the characteristics, pros, and cons of each business entity, let’s look at how to register a company in Malaysia:

- what you need to do before registration,

- documents you might need,

- and how to do it step by step

What to Do Before Company Registration?

1. Choosing a Unique Company Name

Although you can pick any name to your preference, there is still an official guideline you must follow when naming your business.

To go through the exact and full guide, you can access the copy here. However, below is a summarised version :

- The chosen name must use the correct spelling and language

- If the chosen name contains words that are not of Malay or English origin, then the translations of those foreign language words must be provided

- The chosen name should not contain any offensive natured word

- The chosen name shall not have any elements of religion

- The chosen name should not be too vague or general, for example, ‘Intelligent Sdn Bhd.’

- The chosen name can be an individual’s name or names of immediate family members of the director

- The chosen name should not be an acronym for multi-national companies like IBM, KPMG, etc.

After ensuring that your chosen name complies with the above, you should immediately check if it’s available with SSM.

2. Determining the Nature of Business

In order to determine the nature of your business, firstly think about your goals and visions that you have for the business.

Will you need many workers to handle production machineries or will you operate alone to produce an artwork for a client?

Answering these questions will determine the structure of business (sole prop or Sdn Bhd) that will suit your company.

By deciding your structure and entity of business, it will largely determine the nature of your business and the kind of industry it is in.

Other ways of determining your business nature include:

- Through its product or service offered. For example, food and beverages.

- Through the nature of its operation. For example, semiconductor manufacturing

- Or through for-profit or non-profit set up. For example, People for the Ethical Treatment of Animals (PETA), a non-profit organisation

3. Appointing Directors and Shareholders

According to the Companies Act 2016, businesses in Malaysia which are registered must have both shareholders and directors, but what is the difference between the both?

- Shareholder

These are individuals who own shares in your company. They will have direct power in the operations of the business. Although there can be many shareholders in a company, there can also be only one shareholder who owns all (100%) shares of said company.

-

Directors

These individuals are involved in the decision-making and running of the company. You will need at least one director in a Sdn Bhd set up in Malaysia.

When appointing a shareholder it is important to make sure that you ask yourself if your business ownership will be protected. This is because shareholders ‘own’ parts of your company and there will always be a risk of losing the business to the major shareholder, in case that is not you, yourself.

On the other hand, when appointing directors, be sure that they are the right individuals to grow your company according to the value that they bring to your business.

Both these roles are very powerful, so choose them wisely.

4. Establishing a Registered Office Address

You must also submit a registered office address for the company registration in Malaysia.

The main reason for this is to ensure that there is a legal place to act as an intermediary between government agencies and the business on legal matters.

It should also serve as a location that keeps all important documentation, licenses and other materials important to the company.

So, provide an address where you can be easily reached regarding your business. It can also be your private residence address.

Documents Required For Company Registration in Malaysia

Now that you have nailed down all the data collection based on the above pointers, there are a few documents you will need to prepare for a company registration in Malaysia :

- Identification copy of all directors

- Original Constitution form or used to be known as Memorandum and Article of Association form

- Completed Form 13A

- Completed Form 48A

- Completed Form 6

- Partnership agreement (if any)

Step-by-Step Guide on How to Register a Company in Malaysia

Step 1: Online Registration via the SSM Portal

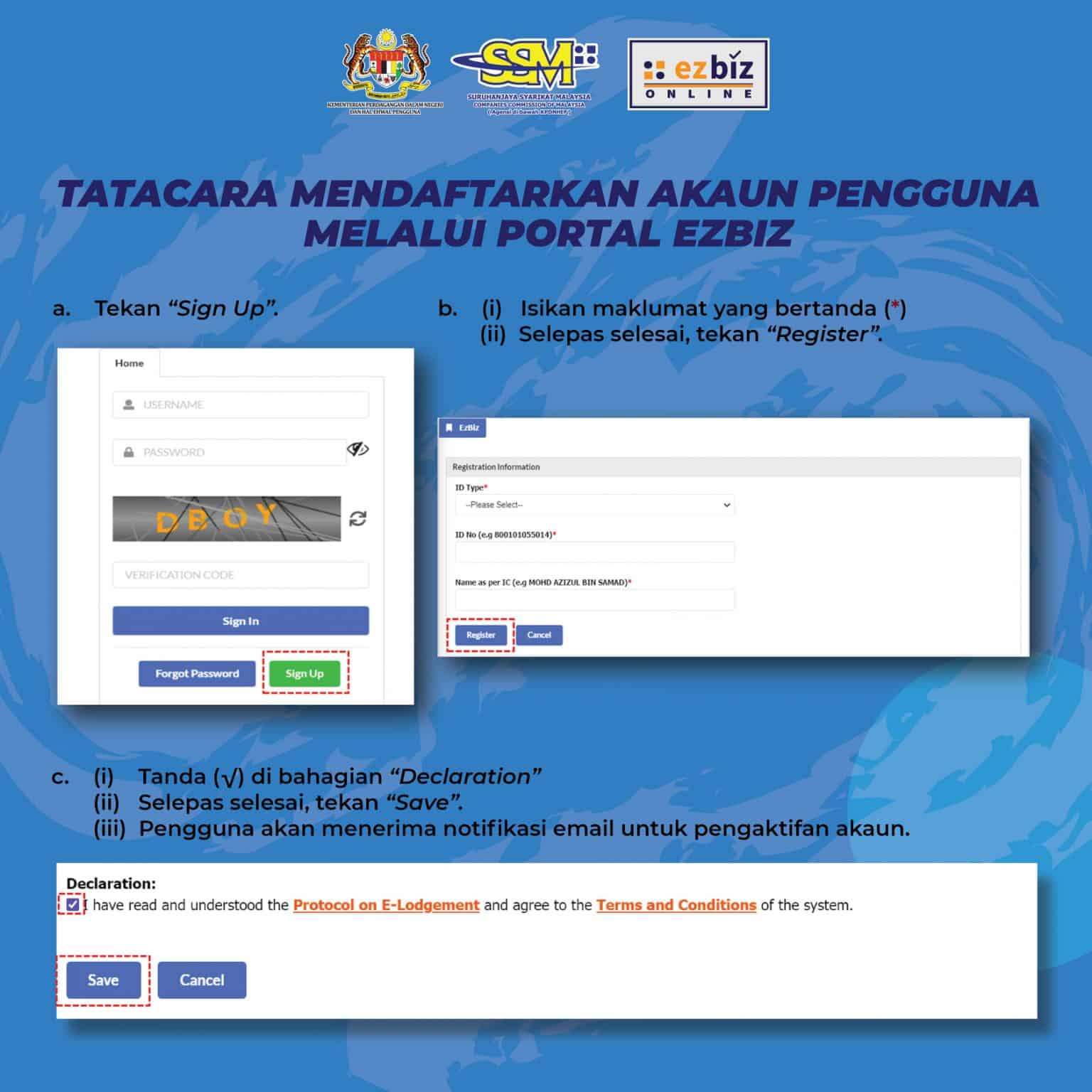

To register your business, apply online with the Companies Commission Malaysia (SSM) at this link: ezbiz.ssm.com.my

Remember to have your ID copy, documents outlined above, and money ready for registration.

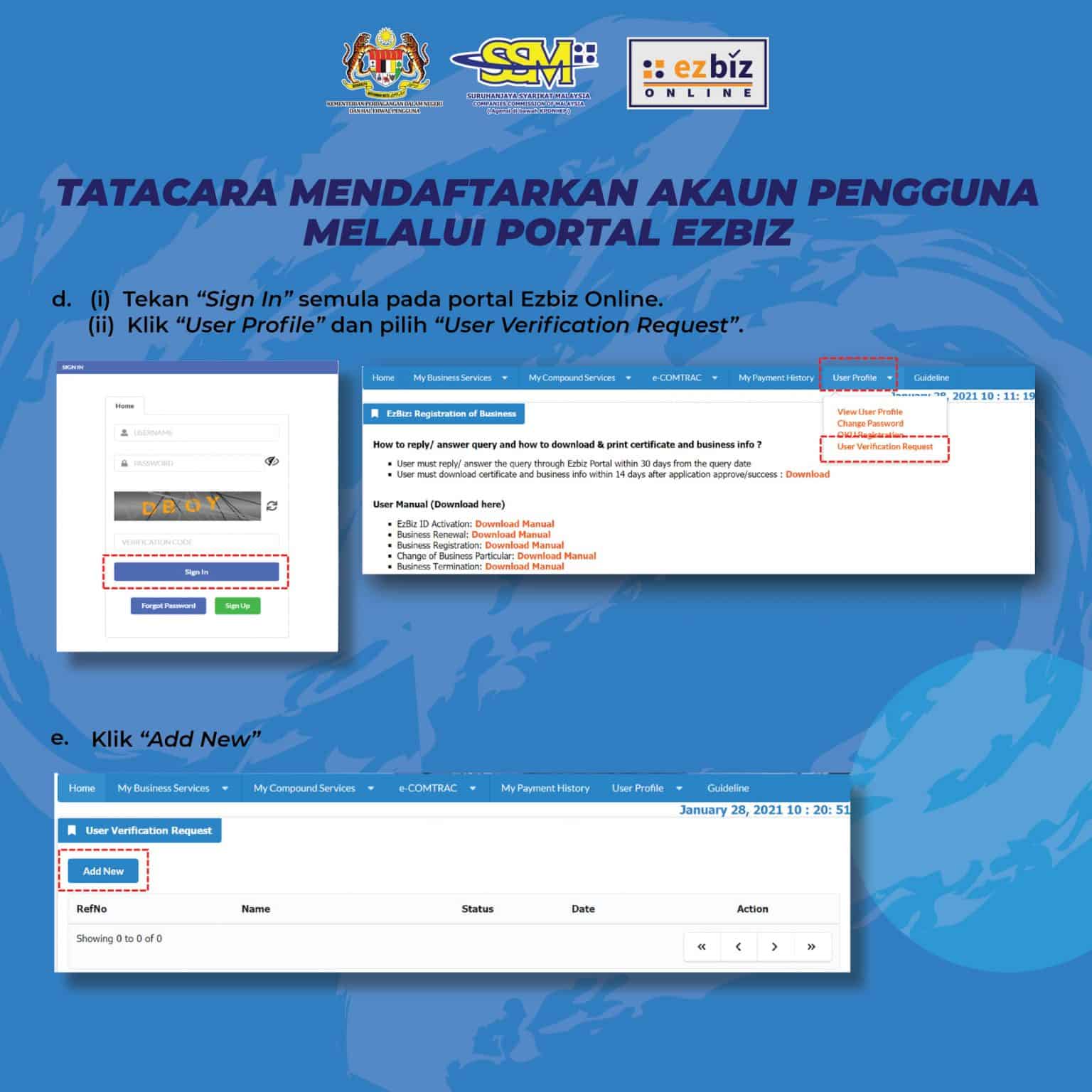

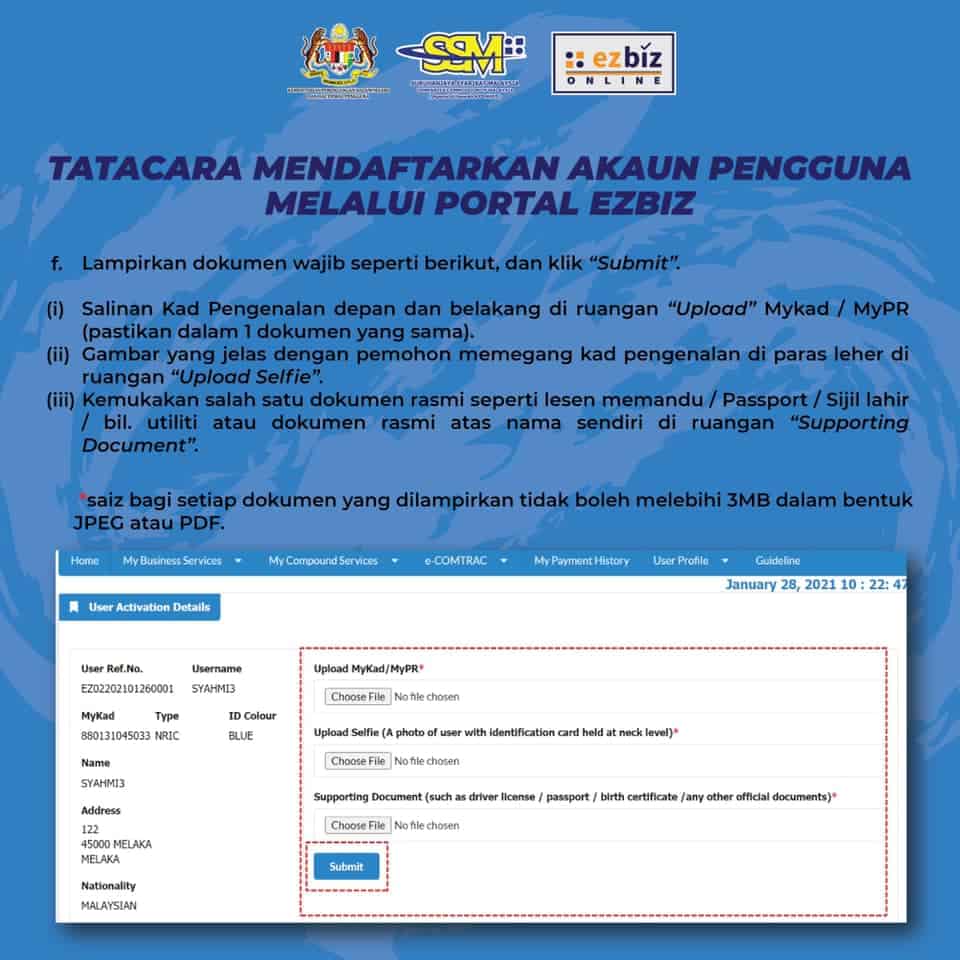

Begin by registering for an account at their portal. You will receive an email for account activation and subsequently receive the login credentials through email.

Step 2: Submission of Required Documents

Submit all the necessary documents needed. At this point, ensure all the documents outlined above are ready to be uploaded.

Step 3: Payment of Registration Fees

Follow through by providing the inputs required. Then, when prompted, make the required payment to complete the entire process. Make sure to save the receipt from this transaction as proof.

Step 4: Receiving the Certificate of Incorporation

Finally, look out for a ‘notice of Registration’ in your email inbox. This is the official documentation for your company registration in Malaysia. Alternatively, you can get the company certificate for a small fee by visiting SSM.

What to Do After Company Registration?

1. Opening a Corporate Bank Account

Once you have successfully registered your business, you must make sure to open a corporate bank account with any of the local banks in Malaysia.

Make sure that you choose a bank that is established so that it can fulfill your business needs, too.

In order to do so, banks will require that you submit documentation such as copies of your ID and Certificate of Incorporation.

Tips: Remember, you must immediately set up your business banking systems and keep them separate from your personal finances to ensure transparent accounting.

2. Applying for Business Licences and Permits (if needed)

Depending on the kind of company registration in Malaysia that you have undertaken and the service or products you might offer as well as the location of your business, you may have to hold special permits and licences.

Ensure you clearly understand any government requirements and pursue applications for licenses and permits before operating your business.

Tips: If you’re struggling to identify or learn about the required licenses and permits, look at the SSM website for resources and guidance to keep yourself informed.

3. Registration for Taxes and Employee Provident Fund (EPF)

As long as your business is set up to make an income and hire people to work, you have to set up two important things:

1. Registration with the IRB to pay income tax or GST(if applicable)

2. EPF for your employees.

Ensure that you keep your accounting books up to date to easily file your returns every year after registration with the IRB. On the other hand, EPF is also equally important as it overlooks the well-being of your employees aside from it being mandatory.

Tips: Use the readily available platforms to file your taxes and EPF contributions. These platforms are convenient and efficient.

4. Compliance with Malaysian Accounting Standards

It is almost an unspoken rule that when you run a company, you must ensure that you comply with the Malaysian Accounting Standards.

This simply means you must keep a record of all transactions within the business as well as proof like invoices and receipts to account for any movement of money in and out of the business.

It is almost impossible to do this all by yourself, so make sure to hire a qualified accountant to keep things in check.

Tips: There are many accounting softwares now that can be used to help you record, maintain and track your accounting if you are struggling to hire an accountant. Utilise these readily available systems to ensure that you keep everything organised and up to date.

Ongoing Legal and Regulatory Compliance

1. Annual Return Filing Requirements

Every year, it is mandatory that you update your annual returns online with SSM within 30 days from your company’s incorporation anniversary, or you might be penalised with a penalty.

This update not only signals to SSM that you’re still operating but this also gives you a chance to make changes for example for additional directors, shareholdings and any other important details.

2. Conducting Annual General Meetings (AGM)

It is mandatory as a company with shareholders and directors to host an annual general meeting to go through the progress of the business and conduct other tasks like appointing directors, addressing shareholder concerns and many more.

This keeps it transparent and complies to what is required from a company. It must also be carried out within 6 months of your financial year-end.

3. Maintaining Company Records and Accounts

Make sure that company records like financial statements, minutes of meetings, are well documented and kept up-to-date at all times.

Why? Because they will come in very handy for yearly audit sessions, filing your annual taxes and helping to stay compliant in accordance with our law in Malaysia.

4. Auditing and Financial Reporting Obligations

Assuming your business size is relatively large, you will need to conduct yearly audits as required by the law.

Choose auditors who are independent to carry out this review and prepare reports to be submitted. Also, ensure all your internal documentations are organised to ensure transparency during audit.

Read also: How to Set Up An Offshore Company in Malaysia

Conclusion

Congratulations! You’ve made it this far! Personally I hope that this guide has managed to provide you with all the information needed on how to register a company in Malaysia.

All in all, remember that choosing the right business entity and structure is extremely crucial. Use the characteristics outlined above along with its pros and cons to select one that matches your business needs accordingly.

Once you’re confident with your choice, you can easily go through the data collection needed prior to registering your business such as choosing a trade name, determining the nature of your business as well as collating other needed documentations.

Upon registration with SSM, remember to make sure that other elements like opening a corporate bank account, obtaining licences as well as tax and EPF registration are all started as well.

It is also vital that you make an effort to understand the legal and regulatory aspects of running a business in Malaysia. As a company, yearly AGMs are required aside from the annual filing of taxes and financial reporting. This will ensure that you stay compliant with what is required by the Malaysian law.

Voila! You should be a lot closer now to starting your business operations! Armed with all this information, I hope that your entrepreneurial journey is a smooth sailing one!

Read also: Exploring Lucrative Small Business Ideas in Malaysia