Stay connected with BizTech Community—follow us on Instagram and Facebook for the latest news and reviews delivered straight to you.

Aster, a decentralized perpetual futures exchange (perp DEX) that was formerly known as APX Finance, became the most popular crypto derivatives platform after its token launch on September 17, 2025. Within days, the ASTER token shot up to an all-time high of $2.17, which was more than 2,500% higher than its starting price of $0.08. At its peak, the project’s fully diluted valuation (FDV) went from $560 million to more than $15 billion.

This remarkable development, which was fuelled by a huge airdrop and a high-profile endorsement from former Binance CEO Changpeng Zhao (CZ), has put Aster ahead of its competitor Hyperliquid in daily income and trade volume, making it the leader in the on-chain perpetuals space. As of September 29, 2025, ASTER is worth $0.3929, which is still 365% more than it was a week ago.

It has a market valuation of $644 million, making it the 113th largest coin in the world, according to CoinMarketCap. Aster’s multi-chain architecture and unique hidden orders feature are attracting traders looking for Binance-level liquidity without the hazards of a central exchange.

The project is backed by YZi Labs (previously Binance Labs) and works with PancakeSwap. In the last 30 days, perp DEX volumes have reached $1 trillion. Aster’s rise shows that the DeFi derivatives market is maturing, but it is still important to stay stable during times of high volatility.

Aster’s history goes back to the merger of APX Finance and Astherus in March 2025. This strategic partnership created a strong perp DEX that concentrated on high-leverage trading in both spot and futures markets.

The platform started on BNB Chain but quickly grew to include Ethereum, Solana, and Arbitrum. It offers up to 100x leverage on more than 100 markets, including crypto, stocks, and commodities.

It also has Miner Extractable Value (MEV) protections to keep users from front-running. This multi-chain agnosticism solves a major problem in DeFi: liquidity fragmentation. It lets trades happen smoothly across networks without the need for bridges or wrapped assets.

The concealed orders feature is what really sets Aster apart. It changes the game in clear on-chain scenarios. Aster’s “Dark Pool Perp” mode hides orders until they are filled, which cuts down on slippage and MEV attacks by up to 90%, according to internal studies.

This is different from most perp DEXs, where limit orders are visible and traders are at risk of being attacked by bots. In June 2025, CZ himself brought this to light by calling Aster’s BTC eternal liquidity “Binance-grade,” which many people take to mean that it has institutional-quality depth. According to Aster’s dashboard, this feature has driven 70% of trades since it launched. It is popular with whales who are worried about Hyperliquid’s transparent liquidations.

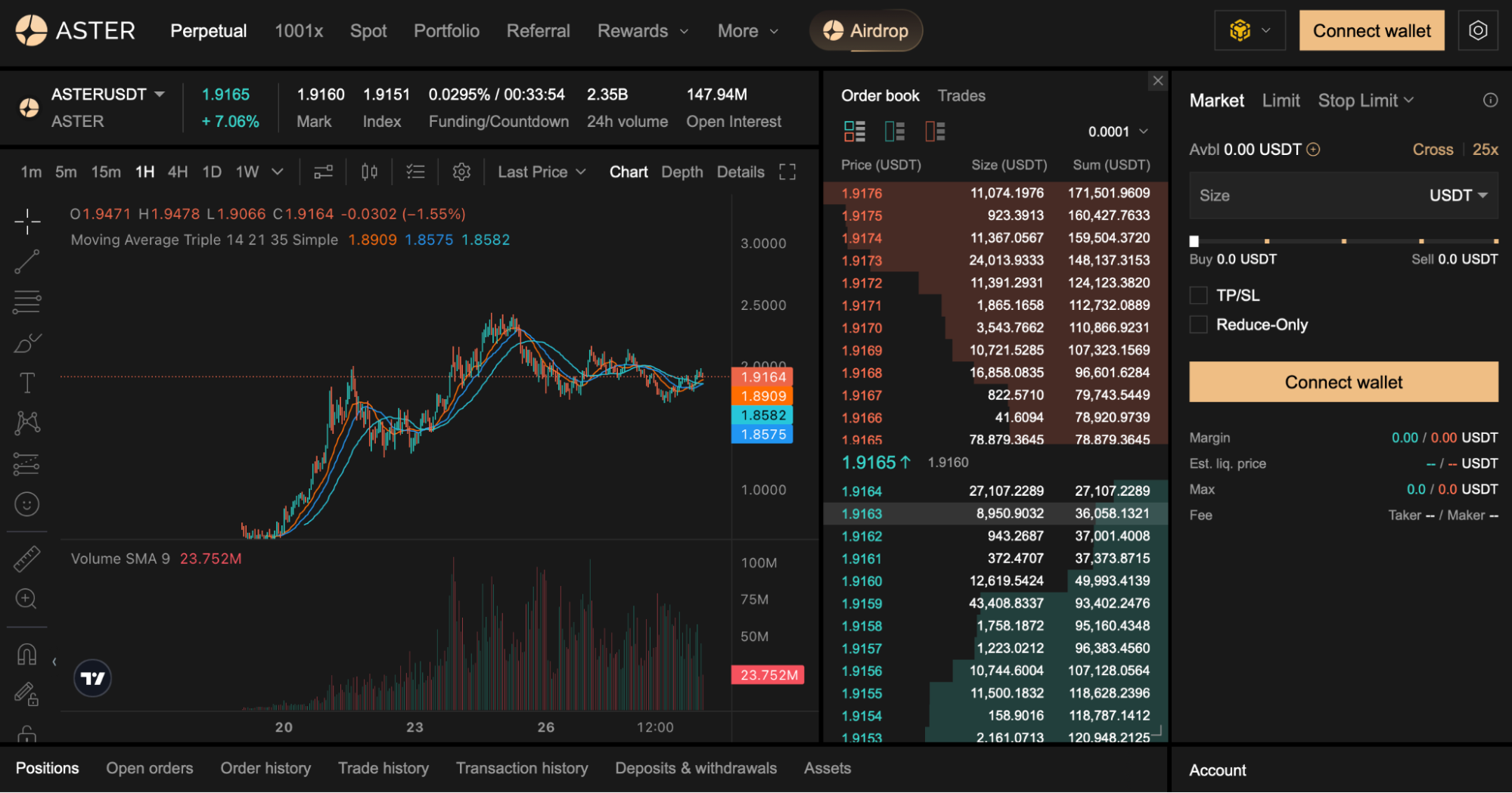

The rise started with the Token Generation Event (TGE) on September 17. ASTER started at $0.08439 on Aster DEX and several CEXs, notably KuCoin, and within hours it had risen to $0.5113, a 500%+ pump. It broke $2 on September 21, but corrections brought it down to $0.39 as the rest of the market got nervous. The daily volume rose 22% to $2.83 billion, and the market cap stayed at $3.6 billion, putting it in the top 100 cryptos.

CZ’s Support: The CZ Bump in Action

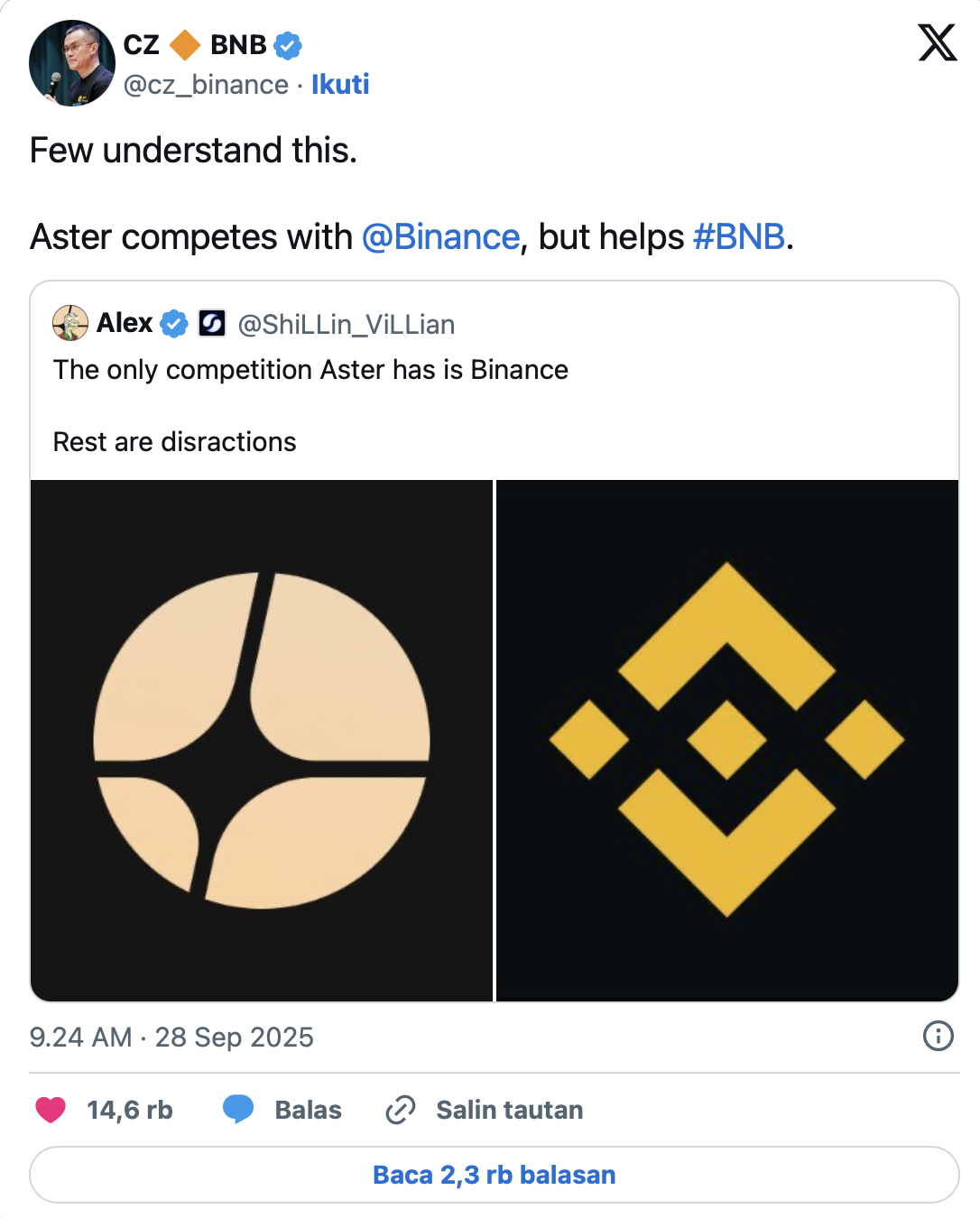

No account about Aster’s rise is complete without CZ’s stamp of approval. On September 17, Binance co-founder tweeted a screenshot of ASTER’s chart, which was going up quickly, with the words “Well done! 👏 Good beginning. “Keep building!”—a post that got 14,000 likes and 2 million views, making people feel like they were missing out.

On September 24, CZ made a joke about Aster’s leverage “cracking him up” and said that it has an edge over its competitors in terms of multi-chain and hidden-order capabilities. His June nod to its liquidity prompted rumors of deeper connections, and some called Aster “Hyperliquid’s Chinese rival” because YZi Labs backed it.

CZ’s “bump” is famous: BNB went from $0.09 in 2017 to $962 at its highest point, while MYX Finance went up 10 times after getting an endorsement. Analysts at MEXC think ASTER may do the same thing, aiming for $5 by the end of the year if volume stays at $9 billion a month from Q3. On X, alpha hunters like praised the risk appetite, while called Aster Binance’s real on-chain enemy, but good for BNB.

Taking the lead in revenue and volume over Hyperliquid

Aster’s numbers depict a story of quick supremacy. According to DeFiLlama, daily revenue is $7.12 million, which is 2.5 times Hyperliquid’s $2.79 million. This is because of 0.025% maker/taker fees and $2.83 billion in 24-hour volume (up 22%). Over the course of three months, the average monthly volume was $9 billion. In September, it was on track to break records thanks to the 300,000+ new wallets from the airdrop.

The 704 million ASTER airdrop (8.8% of the 8 billion supply) through the Genesis campaign, which had a pre-launch volume of $514 billion, sped up adoption in the same way that Arbitrum’s 2023 playbook had.

What makes Aster better? Multi-chain liquidity pools and MEV shielding are different from Hyperliquid’s Solana-only concentration and problems with transparency that led to scandals involving liquidation. With perp DEX trading nearing $1 trillion in 30 days, Aster’s 25% stake shows how well it did.

Risks and the Future

Volatility calms the hype: ASTER’s 26% rise in 24 hours to $2.17 quickly fell down, showing perp DEX beta. There are still hazards with centralization. YZi Labs’ involvement creates “Binance shadow” worries, although audits confirm security. Regulatory tailwinds, such as the GENIUS Act, help expansion, but the CFTC’s close look at derivatives could limit leverage.

Aster wants to have 50% of the market by 2026 with stock perps and AI-powered risk tools. CZ’s tweet on September 28 that “Aster competes with Binance but helps BNB” suggests that the two could work together, which pushed BNB up to $650. For traders, it’s a sure thing; for DeFi, it’s a plan for on-chain CEXs.

Conclusion

Aster’s token launch has changed the way perp DEXs work. It reached an all-time high of $2.17 on CZ’s endorsement, concealed orders innovation, and a $514 billion pre-launch blitz. It now has $7.12 million in daily revenue and $9 billion in monthly volumes, surpassing Hyperliquid. Aster combines Binance liquidity with DeFi transparency, airdropping 704 million tokens to more than 300,000 wallets. This is from APX’s rebranding and its ability to work with several chains like BNB, ETH, Solana, and Arbitrum. CZ says to “keep building,” and the project’s 365% gains show that altseason is starting, but the market is very volatile, so be careful. In a $1 trillion perp market, Aster isn’t just competing; it’s leading. If it keeps up the good work, it may make the next DeFi unicorn.