What Is A Petrol Credit Card?

A Petrol credit card is a particular kind of credit card made to offer advantages and rewards for purchases related to fuel only. Having a Petrol credit card can assist lessen the financial load and offer savings on monthly petrol expenditure in Malaysia, where petrol prices can be a substantial expense for many people.

Benefits of Having A Petrol Credit Card

Malaysian drivers can reap several benefits from petrol credit cards:

- Earn rewards: Get cashback or points on every pump, effectively reducing your fuel cost.

- Budgeting aid: Track expenses and identify areas for improvement using detailed transaction records.

- Manage costs: Ease the financial burden of rising fuel prices by leveraging discounts and rewards.

- Flexibility: Choose a card tailored to your spending habits and interests to maximize savings.

Remember: Responsible credit card use is crucial. Only use what you can afford to repay on time.

How To Choose The Right Petrol Credit Card in Malaysia

To enjoy the benefits and maximise your savings, getting the best Petrol credit card in Malaysia is essential. When choosing a Petrol credit card, keep the following things in mind:

- Petrol Rebate: Search for credit cards that provide enticing petrol rebates. To locate the card that delivers the most cashback or reward points on petrol purchases, examine your alternatives as the rebate rate can vary from card to card.

- Monthly Cap: Some Petrol credit card include a cap on the amount of cashback or reward points that can be earned each month. Make sure the monthly cap enables you to achieve considerable savings based on your spending habits by taking into account your monthly fuel use.

- Additional Spending Categories: Some credit cards for petrol stations also give rewards points or return for purchases made in other categories including restaurants, groceries and internet shopping. If you frequently spend money in these areas, selecting a credit card that offers advantages in several different categories will increase your savings.

- Specific Petrol Stations: Petronas credit cards, for example, are associated with a particular chain of petrol stations. When used at their connected stations, these cards might provide greater cashback rates or additional benefits. Choose a card that matches your refuelling preferences after taking into account your chosen petrol station.

- Additional Benefits: Take into account the credit card’s other benefits in addition to those that pertain to petrol. Some Petrol credit card offer reductions or benefits for spending money on other things like groceries, dining or internet shopping. Your overall savings can increase if you select a credit card with extra features that match your spending preferences.

It’s crucial to keep in mind that the finest Petrol credit card for you will rely on your specific requirements and spending habits. To determine which card will offer the most value and savings for your particular scenario, take into account your frequency of refuelling, favourite petrol stations and other lifestyle considerations.

In Malaysia, you can successfully lower your monthly petrol costs and take advantage of extra points or cashback on your fuel purchases by selecting the right Petrol credit card. In order to select the card that best meets your needs and enables you to save money on Petrol credit card, start looking through the possibilities offered by respected banks and credit card issuers.

Top Petrol Credit Cards in Malaysia

If you drive in Malaysia, you can reduce your fuel costs by using the proper Petrol credit card. These credit cards include a range of features, advantages, and savings that are especially designed to help you save money on a Petrol credit card. Here is a thorough analysis and comparison of Malaysia’s best credit card for petrol in 2024:

| Credit Card | Features | Benefits | Considerations |

|

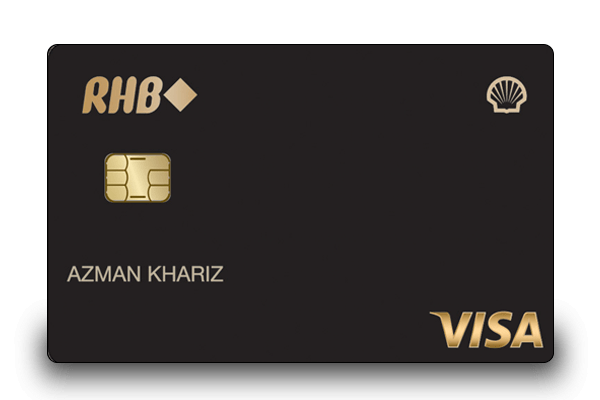

RHB Shell Visa Credit Card

|

– Up to 12% cashback on Shell petrol station

– Up to 5% cashback on specify groceries – Up to 5% cashback on online spending, top-up E-wallet and utility bills. – Annual fee waiver for the first year, following year waived when meet the requirements. |

– Comprehensive cashback category

– Higher cashback monthly cap |

– Different cashback tier for different cashback rate

– Petrol cashback limited to Shell |

|

CIMB Petronas Platinum MasterCard |

– Up to 7% cashback on Setel App transactions.

– Up to 5% cashback with physical card on Petronas spending – 0.2% cashback on other retail spending with no monthly cap – Annual fee free for life |

– Free annual fee

– Benefits to those who prefer Petronas – Travel insurance protection provided |

– Minimum monthly spending RM1,500 to enjoy cashback.

– Petrol cashback limited to Petronas – Not comprehensive cashback category |

|

Aeon Big Visa Gold |

– Up to 5% cashback for petrol transactions on Sundays.

– Up to 5% cashback on other category transactions – Earn AEON Points and redeem gifts |

– Low monthly spending requirement

– Travel insurance protection provided – Aeon rewards point system |

– Cashback rate not higher compared to competitors.

– Limited to Sunday only for petrol transactions. |

|

Alliance Bank Visa Signature Credit Card |

– Up to 5% cashback on all retail purchases

– Complimentary airport rides for business or leisure – 2x e-hailing rides to the airport |

– No minimum monthly spend required

– Free of charge for supplementary card |

– Higher monthly total spend to hit the highest cashback tier

– Higher minimum spend for annual fee waived |

|

HSBC Amanah MPower Platinum Credit Card-i |

– Up to 8% cashback on any petrol stations

– Different cashback tier – Comprehensive cashback category |

– Cashback on petrol, groceries and eWallets with up to 8%

– Enjoy 0.2% cashback on all local and global retail spending |

– Monthly spending with a minimum of RM2,000 to meet the 8% cashback tier

– The annual fee is RM240 – Cashback monthly cap only RM15 |

How to Maximise Savings with a Petrol Credit Card

Using a Petrol credit card can be a wise move if you’re a Malaysian motorist trying to maximise your savings on fuel costs. These credit cards include various features and advantages designed to enable you to save money on fuel purchases. Here are some pointers on how to maximise the benefits of your Petrol credit card and match your credit card usage to your driving style:

- Choose the Right Petrol Credit Card: Choose a credit card for petrol first that provides alluring cashback, incentives or discounts on petrol expenditures. In particular, look for credit cards that offer higher percentages of cashback, reward points, or savings on petrol. Find the credit card that best fits your needs and driving style by comparing its options.

- Understand Cashback and Rewards: Learn how your Petrol credit card’s cashback or rewards system works. For all fuel purchases, some credit cards offer a flat cashback %. However, other cards may offer tiers of cashback rates based on different types of purchases or minimum monthly spending amounts. To maximise your savings, be sure you are aware of the requirements and restrictions related to receiving cashback or rewards.

- Know Affiliated Petrol Stations: Verify the petrol stations that are connected to your Petrol credit card. Some cards might collaborate with particular petrol station chains or brands to offer greater rewards or savings. To maximise your savings, match your refuelling preferences with the connected stations.

- Utilise Supplementary Benefits: Many credit cards provide extra bonuses and incentives in addition to petrol-related benefits in other expenditure areas. You may, for instance, receive cashback or credits when you shop online, go out, or buy groceries. Use the Petrol credit card for other qualified purchases to take advantage of these extra incentives, increasing your overall savings.

- Monitor Promotions and Offers: Keep an eye on the specials and deals that your credit card company offers. Periodically, they might provide extra cashback, bonus points, or special reductions on petrol or associated costs. Keep abreast of these promotions and utilise them when they become available.

- Track and Optimise Expenses: Regularly keep an eye on your credit card and petrol spending. You may evaluate your spending habits and, if necessary, make improvements by keeping track of your Petrol credit card purchases and the accompanying savings. On the basis of your real driving patterns, you may then optimise your credit card usage to maximise savings.

By using these suggestions, you may maximise the benefits of your Petrol credit card and match your credit card usage to your driving preferences. To maximise your savings, choose a credit card that meets your needs, comprehend its cash back or points system, use linked petrol stations and keep an eye on promotions and offers.

Avoid These Pitfalls When Using Petrol Credit Cards in Malaysia

Using a petrol credit card can be great for savings and rewards, but there are hidden dangers to watch out for. Here’s how to avoid common mistakes:

Hidden Charges & Fees:

- Annual Fees: Some cards with high cashback have high annual fees. Analyze if the benefits outweigh the cost.

- Foreign Transaction Fees: Using your card abroad incurs fees. Opt for cards with waived or reduced charges if you refuel overseas.

- Interest Rates: Missing payments leads to high-interest charges. Pay your bills on time and in full to avoid debt.

Clearing Misconceptions:

- Not All Stations Accepted: Some cards offer benefits only at specific stations or brands. Ensure your preferred station is included before applying.

- Limited Cashback on Other Purchases: Petrol cards mainly offer fuel-related rewards. Don’t expect the same benefits for other expenses.

- Automatic Maximum Cashback: Each card has terms and limits. Read the fine print to understand requirements for maximizing cashback or rewards.

Stay Informed, Stay Ahead:

By understanding hidden costs and avoiding common misconceptions, you can maximize your petrol credit card’s benefits and steer clear of unnecessary charges. Always read the terms and conditions to understand the details of your specific card.

Conclusion

By understanding the different features and benefits of petrol credit cards in Malaysia, you can make an informed decision that aligns with your driving habits and financial goals. Remember, responsible credit card use is crucial to maximize the benefits and avoid potential pitfalls. Start your journey to smarter fuel spending today by exploring the wide range of petrol credit card options available and unlock the potential for significant savings.

**Looking for the most ethical and rewarding credit card options? Discover the best credit cards in Malaysia on our informative page.