Stay connected with BizTech Community—follow us on Instagram and Facebook for the latest news and reviews delivered straight to you.

Tether’s stablecoin, USDT, has hit a significant milestone: its market capitalization is $120 billion, approximately Rp1,854 trillion. This figure represents around 5% of the total global crypto market capitalization, valued at $2.39 trillion.

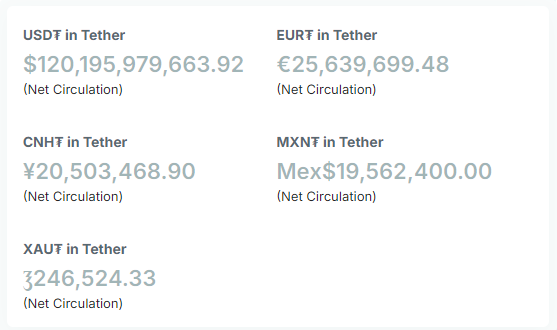

Based on data from Tether’s official website on Monday, October 21, 2024, USDT, the largest stablecoin globally, has surpassed a market capitalization of $120.1 billion. This accounts for nearly 70% of the total stablecoin market capitalization, which is $172.9 billion.

Stablecoins serve as the primary bridge between traditional fiat currencies and digital assets. An increase in stablecoin supply is often seen as a sign of an upcoming bull market, as it indicates that investors are accumulating stablecoins in preparation for cryptocurrency investments.

Out of the total supply of USDT, $61.7 billion is circulating on the Tron network, while $54.9 billion is on the Ethereum network. The remaining amount is spread across other networks like Avalanche, TON, and Solana.

Could the $120 billion USDT supply spark the “Uptober” Bitcoin rally?

Data from Arkham Intelligence shows that approximately $65 million in USDT has been transferred to Binance, and over $20 million to Kraken in the past 48 hours. These inflows suggest significant buying pressure from traders, supporting a bullish outlook that could fuel this month’s market rally, often referred to as “Uptober” in the crypto community. On the other hand, a slowdown in stablecoin inflows frequently signals a market correction.

Can Bitcoin Break its All-Time High by the End of October?

Following September’s downturn, historical chart patterns suggest Bitcoin could be on the verge of a significant three-month rally, potentially reaching $92,000. Analysts point to Bitcoin’s cyclical trends, and October has historically been the second-strongest month for the cryptocurrency. According to CoinGlass data, October has delivered average returns of 21%, trailing only November, which boasts an even more impressive 46% average monthly return.

Looking back at Bitcoin’s 2020 halving cycle, the cryptocurrency surged by over 27% in October, followed by a 42% rise in November. This marked the beginning of a prolonged six-month rally that continued through March 2021. Analysts are now speculating that Bitcoin could see a similar trajectory in the final months of 2024.

For Bitcoin to break out of its current sideways movement, popular crypto analyst Rekt Capital highlights the need for a decisive weekly close above $68,700. Such a move could trigger the next leg of the rally.

Further bolstering this bullish outlook is the growing institutional interest in Bitcoin through exchange-traded funds (ETFs). As of October 17, 2024, Bitcoin ETFs have attracted over $20 billion in net inflows—an impressive milestone reached in just 10 months. To put this in perspective, gold-based ETFs took nearly five years to achieve the same level of inflows. This surge in institutional investment through Bitcoin ETFs could further fuel the cryptocurrency’s anticipated breakout, sustaining momentum through the year’s final quarter.

With these factors in play, Bitcoin seems poised for a potential strong finish to 2024.