Stay connected with BizTech Community—follow us on Instagram and Facebook for the latest news and reviews delivered straight to you.

The US Central Bank, or The Federal Reserve (FED), has officially cut the interest rate by 50 basis points (BPS) to 4.75% – 5% on Wednesday (September 18) US time. Here are the things investors need to pay attention to.

The Federal Open Market Committee (FOMC) issued a result of 11 to 1 for the decision to lower interest rates. This indicates that for the remainder of this year, we can at least expect some more interest rate cuts. The Fed’s interest rate cut has marked the beginning of what market participants hope will be a stable easing of monetary policy, and of course, a reduction in borrowing costs, followed by concerns about the labor market.

“This decision reflects our growing confidence that with the right adjustments to our policy stance, the strength of the labor market can be maintained in the context of moderate growth and inflation steadily moving down to 2%,” said Fed Governor Jerome Powell at a press conference following the announcement.

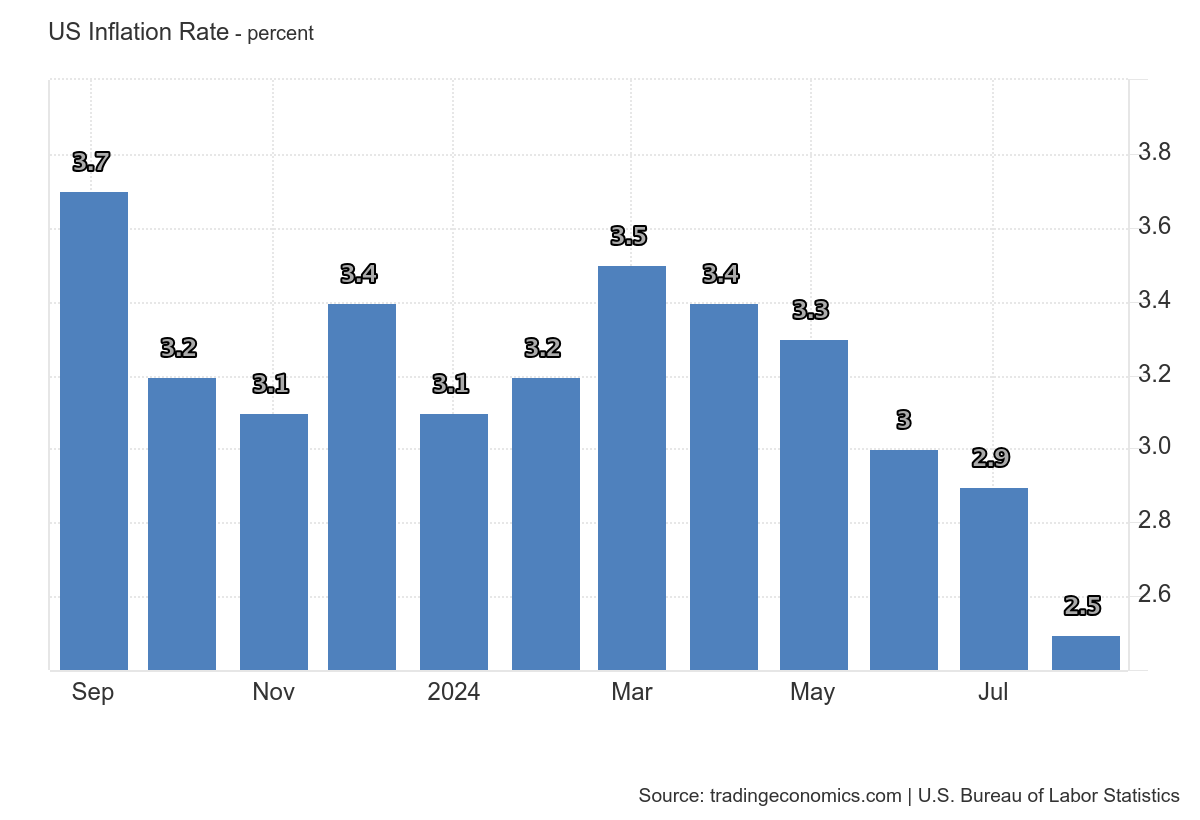

If we look at the latest economic data in the US, it shows that US inflation fell to 2.5% year-on-year in August 2024, down from 3.7% in August 2023. The Fed revealed that their target is to control price stability without an increase in the unemployment rate.

The Federal Reserve is considering a substantial 0.5 percentage point reduction in interest rates. This proposal stems from positive trends in inflation, which is steadily decreasing and expected to fall below the 2% goal. The success of the Fed’s measured approach to monetary policy has led to this favorable outcome, allowing for a more significant rate cut.

Powell clarified that this potential rate reduction should not be interpreted as a shift in overall strategy. Instead, it’s a specific response to current economic conditions and isn’t intended to set a precedent for future decisions. The Fed maintains its commitment to a careful, evidence-based approach in determining interest rates, taking into account a wide range of economic factors.

Unemployment Becomes a Concern for the Fed

Powell explained that the rising unemployment rate in the United States is one of the main drivers for the Federal Reserve to cut interest rates by 50 basis points. (bps). In July 2024, the unemployment rate in the U.S. surged to 4.3%, significantly higher than the rate before the monetary tightening that began in March 2022, when unemployment was at 3.6%. This sharp increase provides a strong reason for the Fed to take aggressive action by cutting interest rates by 50 basis points instead of 25 basis points.

“It is clear that job creation has declined over the past few months, and this needs to be taken seriously,” said Powell.

The decision to lower interest rates by 50 basis points is a rare move by The Fed. In the last 30 years, from 1994 to 2024, The Fed has only cut interest rates by that amount or more in emergency or crisis situations. One significant example is in 2001, when The Fed lowered interest rates in response to the dot-com bubble crisis.

This drastic step reflects the seriousness of The Fed in addressing the threat of recession triggered by a weak labor market, as well as the economic challenges faced by the United States amid global and domestic pressures.

Market Reaction

US stock indices such as the Dow Jones, S&P 500, and Nasdaq experienced a surge at the market’s opening, but subsequently, all three indices closed with a decline.Recently, the price of gold has seen a significant increase, reaching a new all-time high of $2,570.70 per troy ounce, although it has weakened again.

Bitcoin has also experienced an immediate increase. From a price of $58K at the time this article was written, the price of Bitcoin has reached $62K, followed by a rise in other altcoins such as Ethereum and Solana.