Stay connected with BizTech Community—follow us on Instagram and Facebook for the latest news and reviews delivered straight to you.

Bitcoin has experienced a rapid price increase in the last day, breaking the threshold of US$64,300. This surge is triggered by macroeconomic conditions, particularly related to the new policies implemented by China. Based on this development, some market observers project that Bitcoin could reach a price of $78,000 in the near future.

China’s Economic Policy

The People’s Bank of China (PBOC) has officially announced a cut in loan interest rates, hoping that this action can help boost the economy there through increased consumption and productivity among the population.

“Cutting is part of the policy package. Continuously monitoring the strength, frequency, and synergy of the steps that need to be taken in line with China’s efforts to achieve this growth target of around 5% this year,” explained Bruce Pang, Chief Economist for Greater China at Jones Lang LaSalle Inc, as quoted by Bloomberg on Wednesday (September 25, 2024).

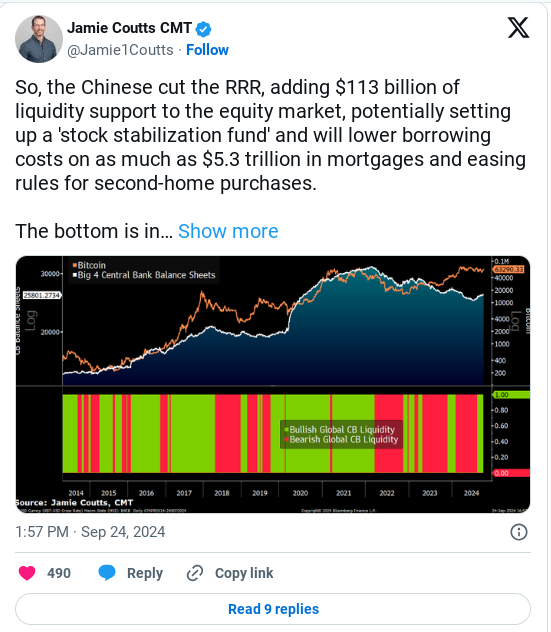

Currently, many analysts have expressed their opinions that prices will rise due to this sentiment. In fact, some analyses have already stated that the impact of this policy will inevitably lead to an increase in liquidity in risky assets such as stocks and cryptocurrencies.

One of them is the Chief Crypto Analyst from Real Vision, Jammie Coutts, who revealed that the POBC policy could potentially influence other central banks to take similar steps.

History shows that decisions made by the People’s Bank of China (PBOC) often have a significant impact on Bitcoin prices. According to Cointelegraph data, there are two interesting examples:

- October 1, 2023: The PBOC injected funds amounting to US$367.7 billion through a reverse repo program. The result? The price of Bitcoin has surged by more than 100%.

- January 2, 2024: The PBOC cuts the bank reserve requirement ratio (RRR) by 0.5%. This action injects $140 billion into the market. Once again, Bitcoin has experienced a significant price increase.

QCP Capital, an analysis firm, views these policies as a sign that the world is moving towards a more accommodative monetary policy. What does it mean? Investors may be more willing to put their money into risky assets like Bitcoin.

Recently, China has taken significant steps again:

1. Cutting the RRR by 0.5%, freeing up around 1 trillion yuan for lending.

2. Setting up a funding program of 800 billion yuan for investment in the stock market.

According to QCP Capital, these two steps have created optimism in the global market.