Stay connected with BizTech Community—follow us on Instagram and Facebook for the latest news and reviews delivered straight to you.

Solana has made headlines again by surpassing Binance Coin (BNB) to claim its place as the fourth-largest cryptocurrency by market capitalization. With its rapidly expanding utility, high transaction volumes, and impressive on-chain activities, Solana is becoming a significant player in the blockchain space, attracting attention from investors, developers, and institutions alike.

Solana’s All-Time High in Real Economic Value

Solana recently reached an all-time high of $11.09 million in real economic value, setting a new record for the blockchain network. This achievement was largely driven by increased transaction fees and Maximum Extracted Value (MEV) tips, reflecting robust on-chain activity fueled by a growing memecoin market.

Since October 19, Solana has also managed to surpass Ethereum in real economic value, establishing itself as a formidable competitor in the blockchain ecosystem. This surge in value highlights not only the growing popularity of the network but also its capability to support high transaction volumes, making it an appealing option for those looking to engage in decentralized finance (DeFi), NFTs, and other blockchain applications.

Market Performance and Price Surge

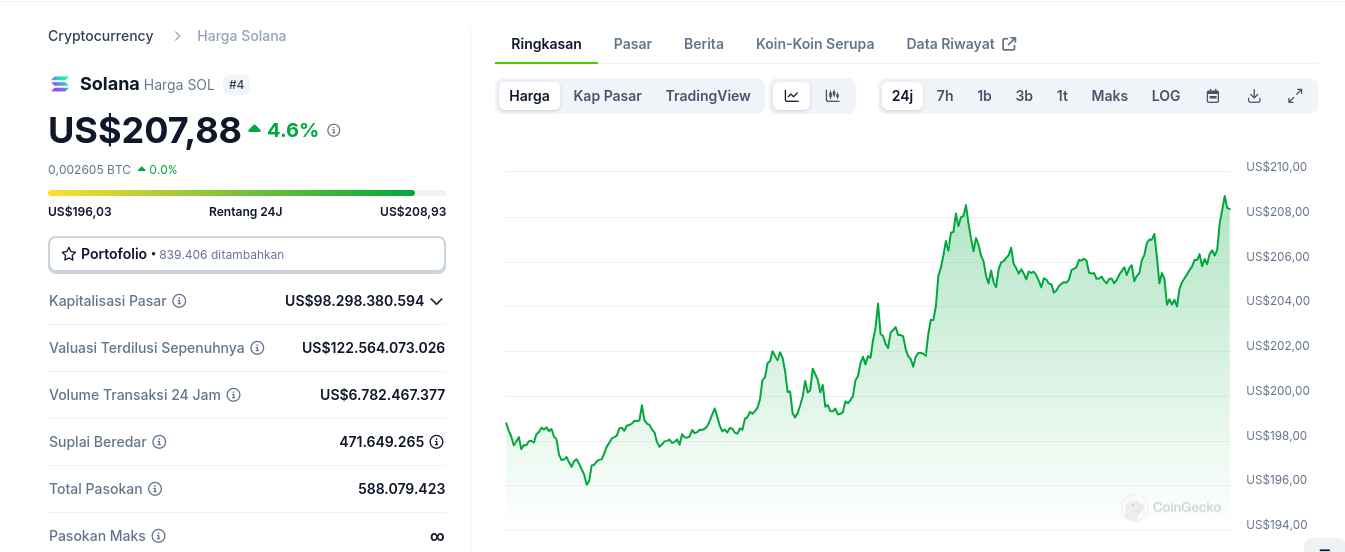

Currently, Solana’s trading price has reached $207, with a significant 20% increase in trading volume over the last 24 hours, bringing the total to $7.5 billion. This strong performance has led to a market capitalization of around $89 billion, allowing Solana to surpass Binance Coin (BNB), which stands at $86 billion.

Solana’s impressive rise in market cap is not only due to speculative interest but is also backed by technical strength and a network that developers and users can rely on for building and interacting with decentralized applications.

Solana’s ETF Potential and Market Impact

Following the U.S. presidential election, there is renewed optimism in the crypto community about potential regulatory support for blockchain technology and digital assets under new leadership. The recent political shift has generated hope for a more favorable regulatory climate, with some expecting changes in SEC leadership, particularly the possible removal of Gary Gensler, who has taken a stricter stance toward crypto assets.

For Solana, this optimism has translated into increased interest in a potential U.S. spot Exchange-Traded Fund (ETF). Market analysts, including Geoffrey Kendrick, Head of Digital Asset Research at Standard Chartered, believe that a Solana ETF could thrive in a supportive regulatory environment, opening the door for broader adoption and investment.

If an ETF were to launch, analysts forecast that Solana’s price could surge by 100 to 400 times, with some predicting it could reach $10,000 per token over the next few years. The approval of a Solana ETF could serve as a catalyst for both institutional and retail investors, expanding the reach and liquidity of SOL and supporting further growth across the Solana ecosystem.

TVL Surge in the Solana Ecosystem

In recent days, Solana’s Total Value Locked (TVL) has seen a dramatic rise, increasing from $5.93 billion on November 6 to $7.27 billion on November 9. This $1.1 billion jump within a short period demonstrates the heightened demand for Solana’s blockchain applications and services. Compared to other major layer-1 protocols, Solana’s TVL growth outpaces Ethereum’s 10% increase and BNB Chain’s 0.5% rise over the past 30 days, showing that Solana is not only capturing attention but also attracting significant funds into its ecosystem.

This growth in TVL is a strong indicator of demand for SOL tokens, which in turn has a positive effect on the token’s price. Additionally, the continued rise in TVL underscores the network’s long-term DeFi potential and indicates that Solana may be transitioning from a blockchain known mainly for fast, low-cost transactions to one capable of supporting sophisticated, high-value applications.

Challenges and Opportunities Ahead for Solana

As Solana continues to gain traction, it also faces significant challenges that could impact its long-term success. One of the main challenges is ensuring that the recent spike in activity, largely driven by memecoin transactions, becomes a sustainable trend rather than a temporary phase. Many in the crypto community are calling for Solana to evolve beyond its current image as a fast and affordable transaction platform, suggesting that it should aim to support more complex and sustainable applications, such as advanced DeFi solutions and NFTs.

Regulatory concerns present another potential hurdle. In the United States, the Securities and Exchange Commission (SEC) has scrutinized Solana, classifying it as an unregistered security. This classification, along with the broader regulatory uncertainty surrounding crypto assets, could limit Solana’s growth prospects in the U.S. market. Nevertheless, there is optimism within the community that regulatory policies may shift to become more accommodating, particularly with new political leadership in place.

Despite these challenges, Solana has managed to attract the attention of prominent financial institutions and investors. With a growing ecosystem that includes plans for a Euro-backed stablecoin and additional DeFi projects, Solana’s future appears promising. The network’s ability to continue expanding its use cases and maintain its high growth rate will be critical to its success in the rapidly evolving blockchain landscape.