Stay connected with BizTech Community—follow us on Instagram and Facebook for the latest news and reviews delivered straight to you.

The United States election in 2024 could be one of the most influential in its history. This election is expected to determine the direction of the country amid important issues such as jobs, immigration, and healthcare. However, there is one other topic that is now taking center stage: cryptocurrencies.

After years of intense scrutiny from the SEC and regulatory uncertainty, the crypto industry is hoping that the incoming administration can offer clearer policies that support the development of the sector. Today, crypto is a cross-party issue; both Democrats and Republicans see an opportunity for the US to lead in the industry.

Politicians are starting to pay more attention to the sector as many potential voters among crypto investors are undecided. In the near future we will see the results of the election, so Biztech will compare their policies and perspectives on the crypto industry.

- 🗳️: The 2024 U.S. election could reshape crypto regulation, with Trump and Harris offering different views that might lead to contrasting paths for the industry.

- 💰: Trump proposes holding government-seized Bitcoin, creating a Crypto Advisory Board, and reducing capital gains tax – all measures aimed at boosting U.S. crypto leadership.

- 📉 Harris supports raising taxes on high-income earners, which could impact crypto investors with large portfolios. She also emphasizes equitable financial access through crypto, though has fewer direct crypto policy statements.

- 🌐 Both candidates could affect Bitcoin’s value and the broader market, with analysts warning of inflation risks under Trump’s trade policies and mixed investor support for Harris’ approach.

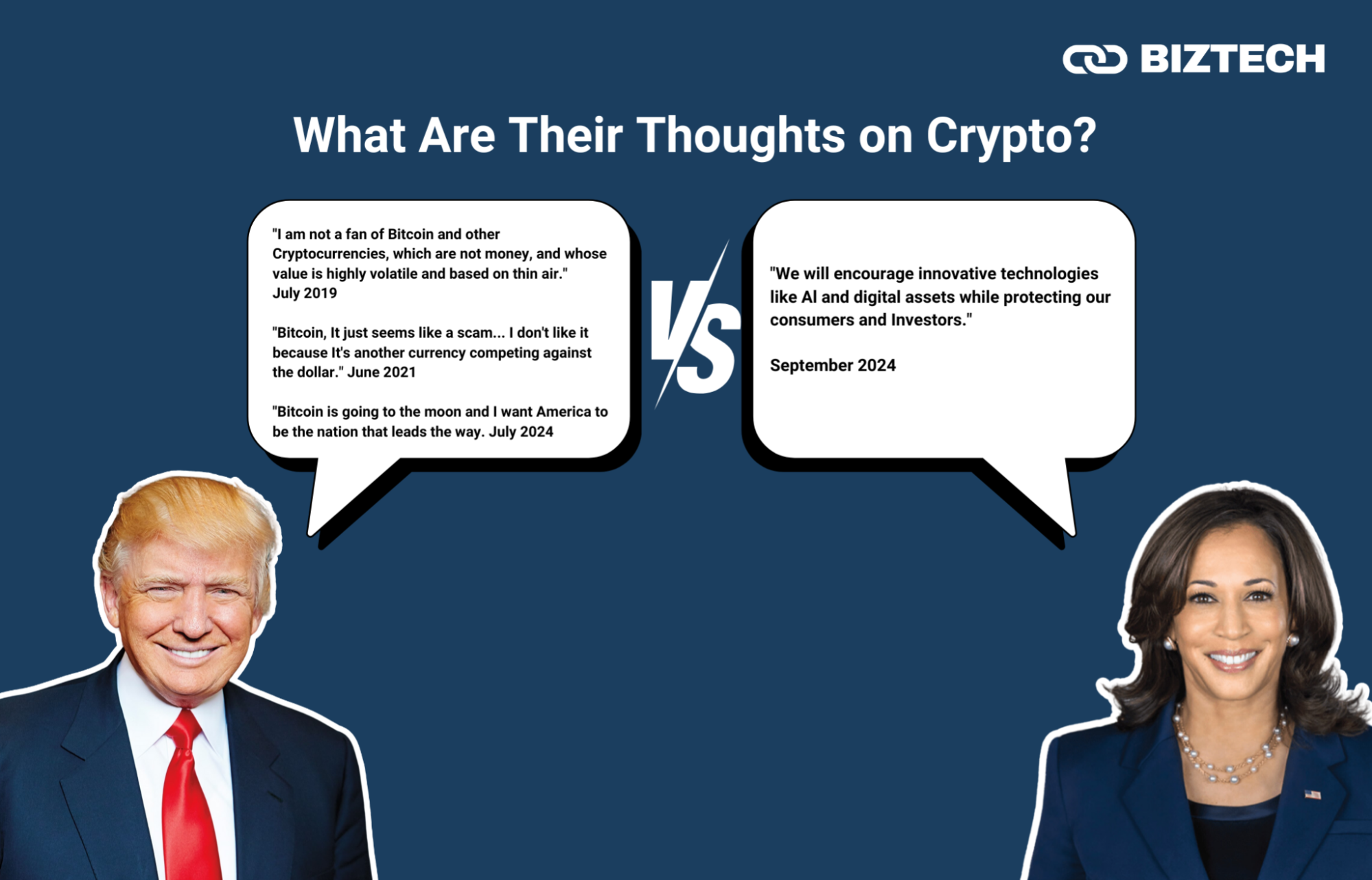

What Are Their Thoughts on Crypto?

Donald Trump’s outlook on crypto is becoming brighter, influenced by two main factors: he is openly seeking support from the sector and has been campaigning longer.

Meanwhile, Kamala Harris’ campaign faced challenges from the start. Joe Biden abruptly withdrew from the race in July after an unsuccessful debate, and Harris was only officially confirmed as the Democratic candidate a month later.

Many voters hoped that Harris would bring a new approach to digital assets, different from her predecessor’s stance. Despite the positive signals, her support for crypto still seems less strong than Trump’s position.

From some of the statements of both candidates, it appears that Trump’s views on Bitcoin and crypto were not always as positive as they are now.

It’s noticeable that Kamala Harris rarely addressed crypto directly in her campaign, while Trump has been active on the crypto stage, including speaking at Bitcoin 2024.

While Harris hasn’t made many statements regarding digital assets, there are subtle hints to her supporters that the direction of policy towards crypto could change if she is elected president.

What’s Their Take on Crypto Regulation?

Despite the notion that the crypto sector is averse to regulation, many entrepreneurs believe that legal certainty will help the industry grow while increasing investor confidence.

This is an area of concern in the policies proposed by Kamala Harris and Donald Trump, as regulations could determine whether the US becomes a leader in crypto or falls behind.

In this case, Trump is more open about his plans and views. While Harris’ campaign outlined the policy through several documents and papers.

Trump has long criticized the SEC and promised to remove its chairman, Gary Gensler, “on the first day” in office, although some legal experts doubt the smoothness of the move.

In contrast, Harris in her latest document conveys the Democrat’s plan to support black men, indirectly recognizing crypto’s potential to help those who struggle to access conventional financial services.

What’s Their Plan on Crypto?

Some in the crypto community have questioned Kamala Harris’ policy focus on a specific group, instead of taking a blanket approach to all Americans. However, to understand the potential impact of her policies on investors, especially regarding taxation, it is interesting to look at.

Harris promised not to raise taxes for families with annual incomes below $400,000. However, for high-income groups, especially those earning over $1 million per year, the capital gains tax rate will likely increase from 20% to 28%.

One of the controversial ideas she proposed is a tax on unrealized capital gains for individuals with a net worth of more than $100 million. This means the tax would be applied on all assets, including property, stocks, and crypto, even if they have not been sold.

On the other hand, Trump has not released an official statement regarding the change in capital gains rate, but speculations suggest that he plans to lower the rate from 20% to 15%. In addition, Trump has also proposed some specific policies for the crypto sector, including:

- Withholding the sale of Bitcoin seized by the government and keeping it as a “strategic reserve.”

- Establishing a Crypto Advisory Board to help steer regulation.

- Opposing the issuance of central bank digital currencies in the US.

- Encouraging the remaining unmined Bitcoin to be mined on US soil.

However, some question whether these policies are realistic, especially its ambition to enlarge the US role in Bitcoin mining globally.

Trump Vs Harris in crypto-related endorsements

Trump, famous for his recent change of opinion on Bitcoin, has attracted more crypto support than Harris. One factor is the timing of their campaigns – while Harris officially entered the race in July as the Democratic nominee, Trump had announced his candidacy almost two years earlier, in November 2022. Names like Elon musk, Robert Kiyosaki, Jeremy Kauffman populate the rosters of his supporters.

Harris, on the other hand, began receiving crypto endorsements a few months later. Her first notable backing came in August 2024 from JP Thieriot, former CEO of Uphold. Around the same time, John O’Farrell, a general partner at crypto-focused venture capital firm Andreessen Horowitz (a16z), also announced his support for Harris.

How Much Crypto Do They Own?

Tracking each candidate’s personal investment portfolio offers valuable insight into their financial priorities and level of commitment to the issues they promote. By examining where they allocate their resources, we can gain a clearer picture of whether their financial interests align with their policy positions.

When comparing the two candidates, only Trump has investments in cryptocurrency, underscoring a distinct approach to digital assets. Harris, on the other hand, holds exchange-traded funds (ETFs), but recent filings reveal that his ETFs do not include any that track the spot price of Bitcoin—a type of product that has surged in popularity following its SEC approval in January.

What’s next for the Crypto Industry

America is facing big decisions, and the cryptocurrency world is just one element of a broader overall picture. Some economists caution that Trump’s other policies, such as the implementation of trade tariffs, could risk triggering inflation which could then impact the crypto market indirectly.

On the other hand, some critics have cast doubt on Trump’s commitment to the crypto community, suggesting that he may just be making promises with no intention of keeping them, simply to gain support. As election day approaches, there is a growing sense of optimism in the crypto market.

Whether the effects will be felt immediately on election night or only in the coming weeks or months, the final outcome has the potential to significantly affect Bitcoin’s value.