Stay connected with BizTech Community—follow us on Instagram and Facebook for the latest news and reviews delivered straight to you.

The current price of Bitcoin is moving sideways after experiencing a significant increase ahead of the halving in April 2024. In addition, the month of September is known as a less favorable period for Bitcoin.

For over two years, the market has been shaped by expectations of rising interest rates. However, this started to shift in mid-2023. Out of the last ten meetings, including the one on July 31, the Federal Reserve kept rates steady nine times after raising them 11 times during this economic cycle. Now, many analysts believe a rate cut is coming soon, as inflation, which hit 3% in June, is being brought under control.

Considering this situation, what are the prospects for Bitcoin in the future? What steps can be taken to continue generating profits? Keep reading this article until the end.

The Fed Predicted to Cut Interest Rates by 25 Basis Points to Avoid Hard Landing

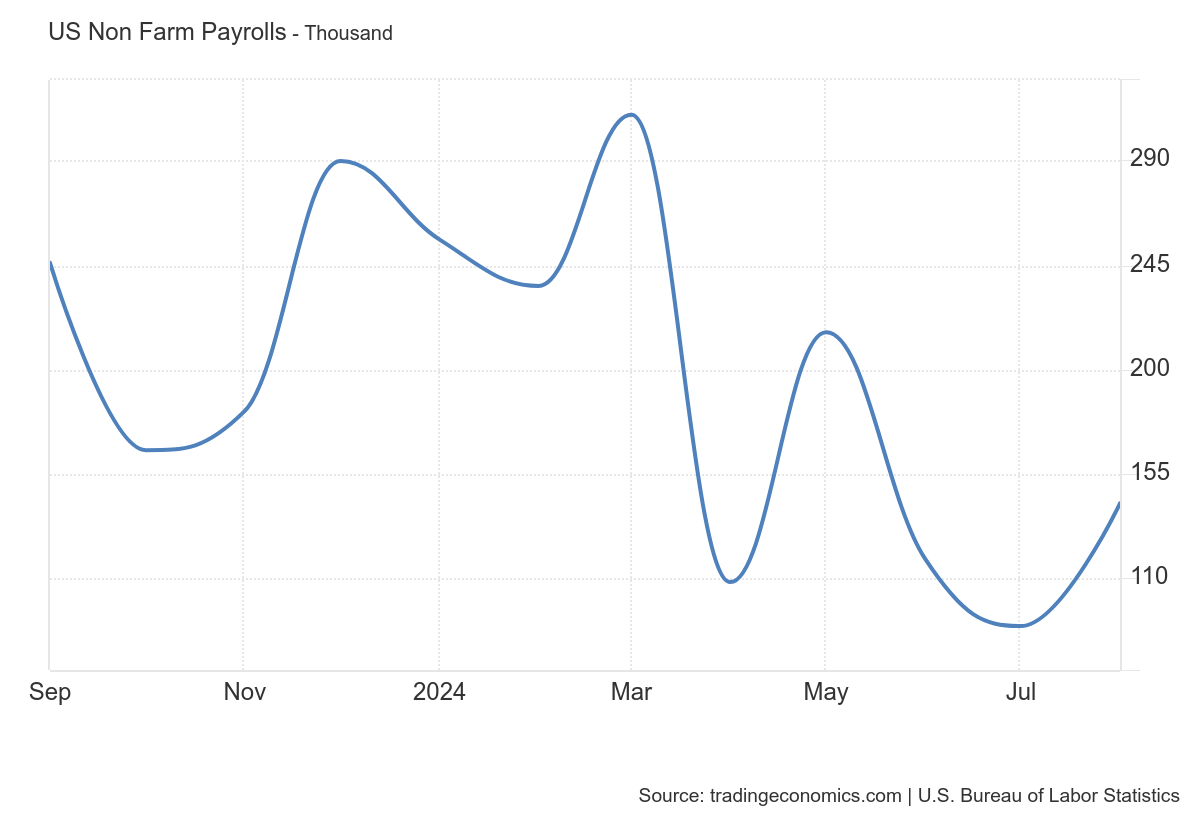

In recent months, the US economy has shown signs of weakening, particularly in the labor sector. One important indicator that is often monitored is Nonfarm Payrolls. The latest data shows that the 3-year moving average of nonfarm payrolls is now just slightly above 200,000 jobs. The question is, does this trend lead to a recession?

History shows that nonfarm payroll is one of the early indicators that can predict a recession. Every time the 3-year moving average from the data above falls below 100 thousand, as happened during the dotcom crash in the early 2000s and the subprime financial crisis in 2008, the US enters a recession. The graph illustrating this cycle shows that each time this number drops drastically, a recession almost certainly follows.

If nonfarm payroll numbers continue to decline and eventually fall below 100,000, it could be a strong signal that a recession is imminent. Many economists and market analysts use this indicator as an early signal to anticipate a larger economic downturn. Who can prevent the economic decline? The answer is clear: The Fed. If The Fed aggressively cuts interest rates, there is a great chance that the US economy can avoid a recession.

Moreover, as of September 11, US inflation data has been released at 2.5%, which is below the consensus of 2.6%. The Fed’s inflation target of 2% is getting closer, so based on these two economic data points, there should be no reason to delay the interest rate cut on September 18.

Bitcoin Seasonality in Over a Decade

Since 2010, Bitcoin’s performance in September has indeed been poor, with an average correction of 5.65 percent from 2010 to 2023. However, during halving cycles, September often shows an increase. For example, in 2012, Bitcoin rose by 24.03 percent in September, and in 2016 it increased by 6.35 percent. However, in 2020, Bitcoin experienced a decline of 9.87 percent. Throughout 2024, the trend in crypto transactions shows that retail traders tend to sell their assets due to an unfavorable market, while whales or large investors are actually buying up Bitcoin.

Bitcoin Price Analysis: If the Bullish Scenario Happen

The plan for the Federal Reserve (The Fed) to cut interest rates in the second week of September 2024 could have a positive impact on Bitcoin. The reason is that it makes high-risk assets like Bitcoin start to attract interest as liquidity in the market increases.

However, the interest rate cut this September may not immediately cause Bitcoin prices to soar. This is because the level of liquidity flowing into the market will depend on how much The Fed reduces interest rates.

If the interest rate cut only occurs once this year by 25 basis points, the effect on liquidity in the market will not be very significant. However, if it happens 2-3 times, it could make Bitcoin more appealing.

Bitcoin, which has been declining since March 2024 from a price of $73K, continues to move downward consistently, creating higher lows and lower lows until a channel has formed. As this article is being written, Bitcoin is trading at a price level of $58K, having previously bounced back from its demand area at $50K.

In the short term, Bitcoin will target $64K first, and from there the market will determine whether Bitcoin will continue its rise throughout the end of the year or not. If the resistance at that level is breakout, then the Bullish flag pattern is confirmed valid.

Disclaimer: The content provided on Biztech Community is intended just for informational and reference purposes and should NOT be construed as investment or trading advice. The material presented in this article does not serve as an encouragement, recommendation, offer, or endorsement to buy or sell any crypto assets. Trading in financial markets, including cryptocurrencies, carries inherent risks and may result in financial losses. All investment and trading decisions are the responsibility of the investor, who should be fully aware of the associated risks and rewards.